When you think about the money you will need for future expenses, what feeling comes up first?

For many, the answer isn’t excitement or anticipation. It’s a quiet, persistent dread. It’s the knot in your stomach when the car makes a new, unfamiliar sound. It’s the low-grade anxiety that hums in the background when you think about your kid needing braces, the roof eventually needing to be replaced, or the holidays fast approaching.

Unexpected Expenses Can Blindside You

This feeling is incredibly common. It often stems from viewing your money on a purely monthly basis. You know what you need to cover this month’s rent, this month’s groceries, and this month’s bills. But when an expense appears that doesn’t fit neatly into that monthly box, the only question your brain can ask is,

“Can I afford this right now?”

This short-term focus can lead to a cycle that feels impossible to escape. A car needs a $2,000 repair that you don’t have in cash. The dealer presents a seemingly perfect solution: trade in the old car and drive away in a new one for just a few hundred dollars a month. In that moment, it feels like a win. You’ve avoided the big repair bill and solved your transportation problem. But the reality is you’ve traded a one-time problem for a seven-year commitment that will cost you thousands in interest, trapping you deeper in the month-to-month mindset.

You Can Break the Cycle

The good news is that you can break this cycle. You can transform that feeling of dread into a sense of confidence and clarity. It’s not about restriction or sacrifice; it’s about shifting your perspective and building a system that prepares you for the future. It’s about seeing your whole money picture so you can make decisions that serve your long-term well-being, not just your short-term stress.

Here are five powerful ways to beat that feeling of dread and take confident charge of your money.

Way #1: Gain Total Clarity by Seeing Your Entire Money Picture

You cannot plan for what you cannot see. When your financial life is spread across a checking account, two credit cards, a savings account, and a car loan, your view is fractured. You see individual transactions, but you miss the larger patterns. It’s like trying to navigate a cross-country road trip by only looking at the ten feet of pavement directly in front of your car. You might handle the immediate curve, but you have no idea what’s coming over the next hill. This “financial fog” is a primary source of money anxiety. You feel like you’re just reacting because you don’t have the information to be proactive.

Your First Action: Centralize Your Money Data

The foundational step to beating dread is to bring all of your financial information into one place. When you can see all your accounts, balances, and transactions together, the fog begins to lift. For the first time, you might see exactly how much you’re spending on dining out, how many small subscription services are adding up, or how quickly your savings are (or aren’t) growing.

This single, unified view is the bedrock of financial confidence. It replaces assumptions and worries with facts. The goal isn’t to judge your past spending but to understand it so you can guide your future spending with intention.

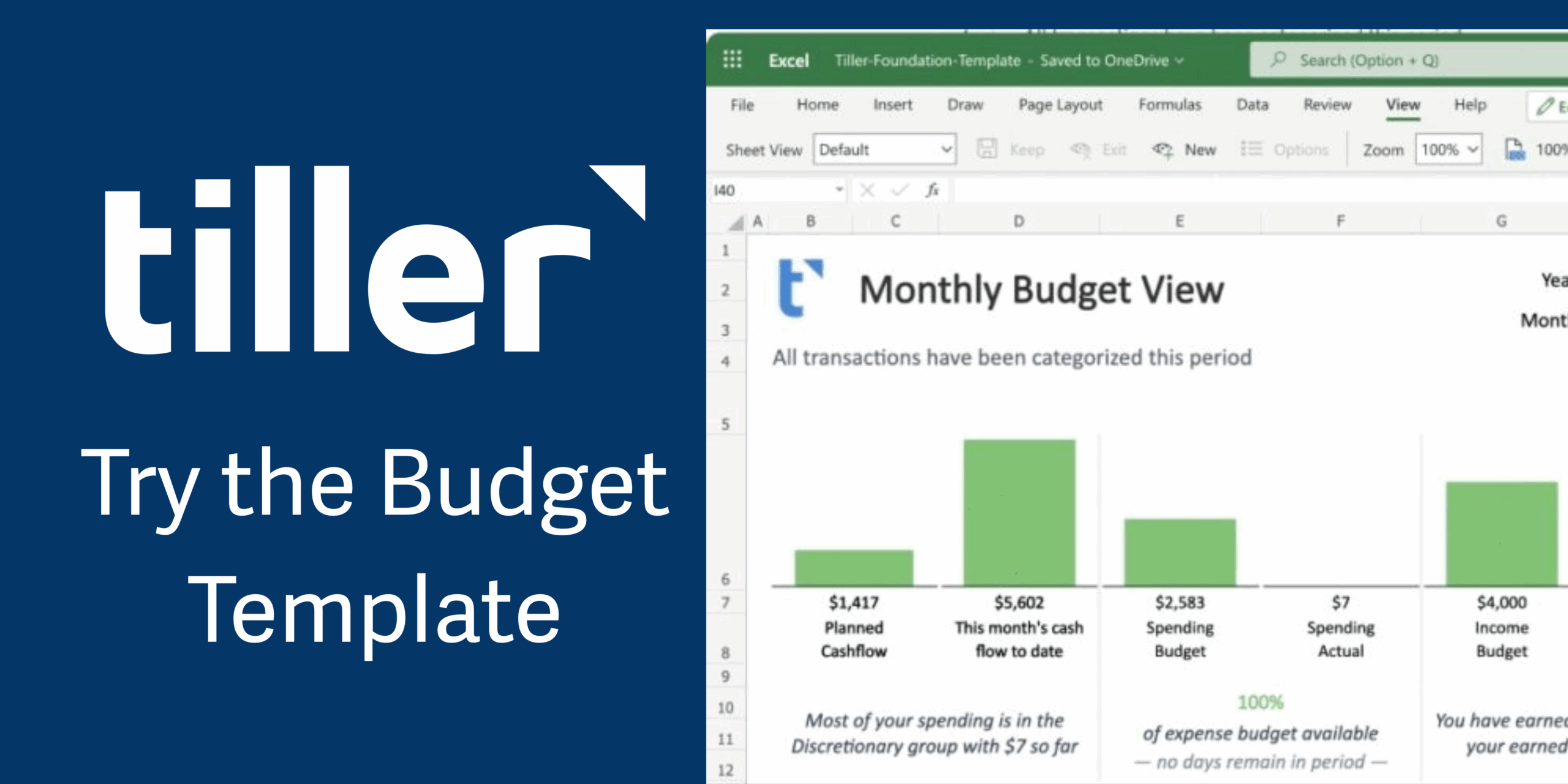

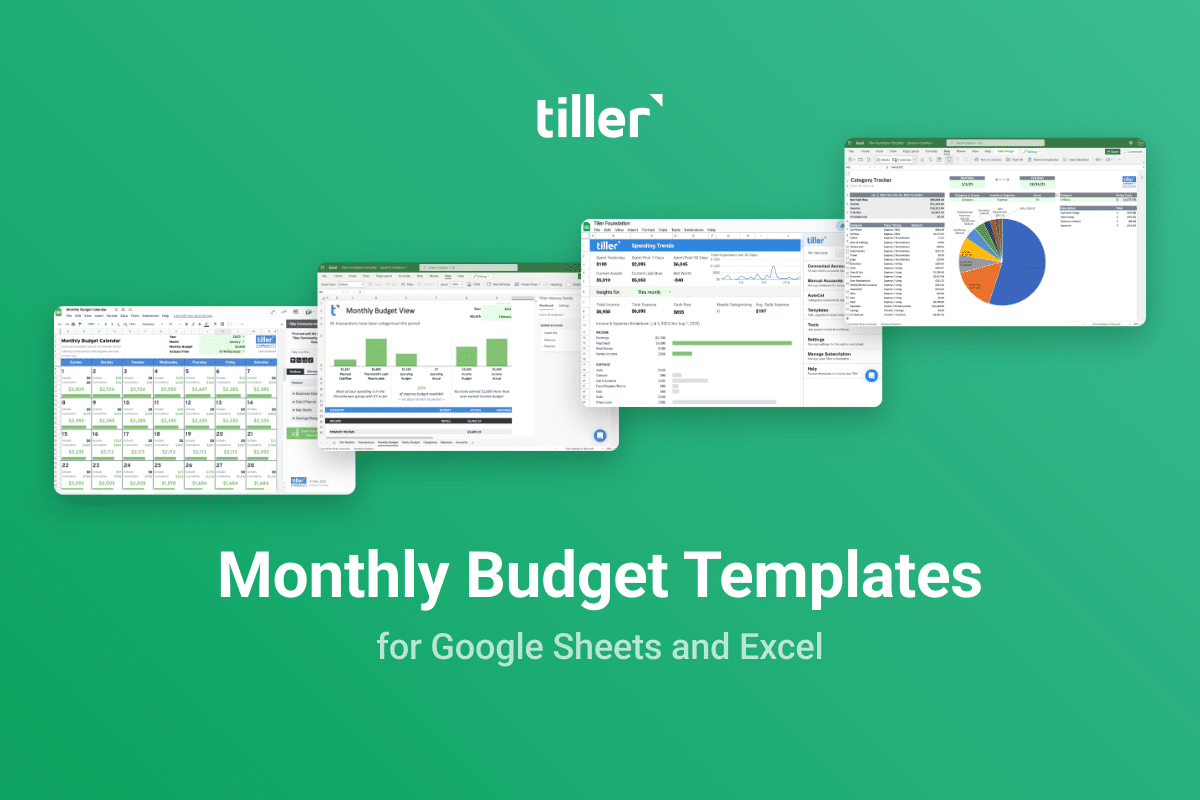

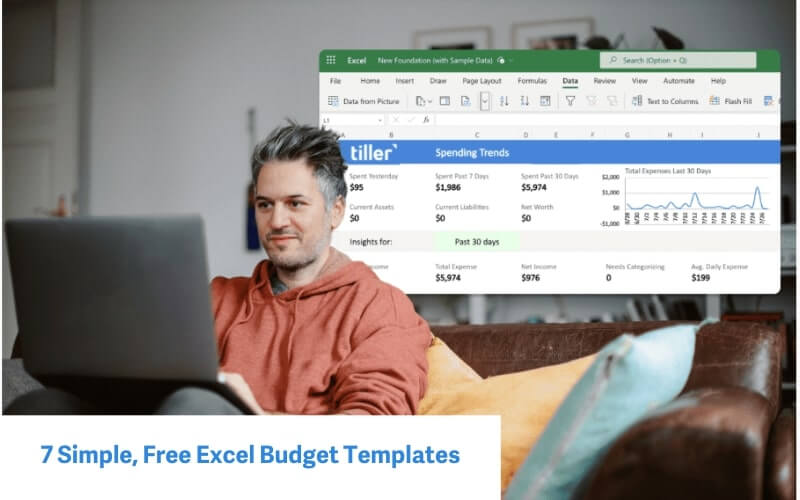

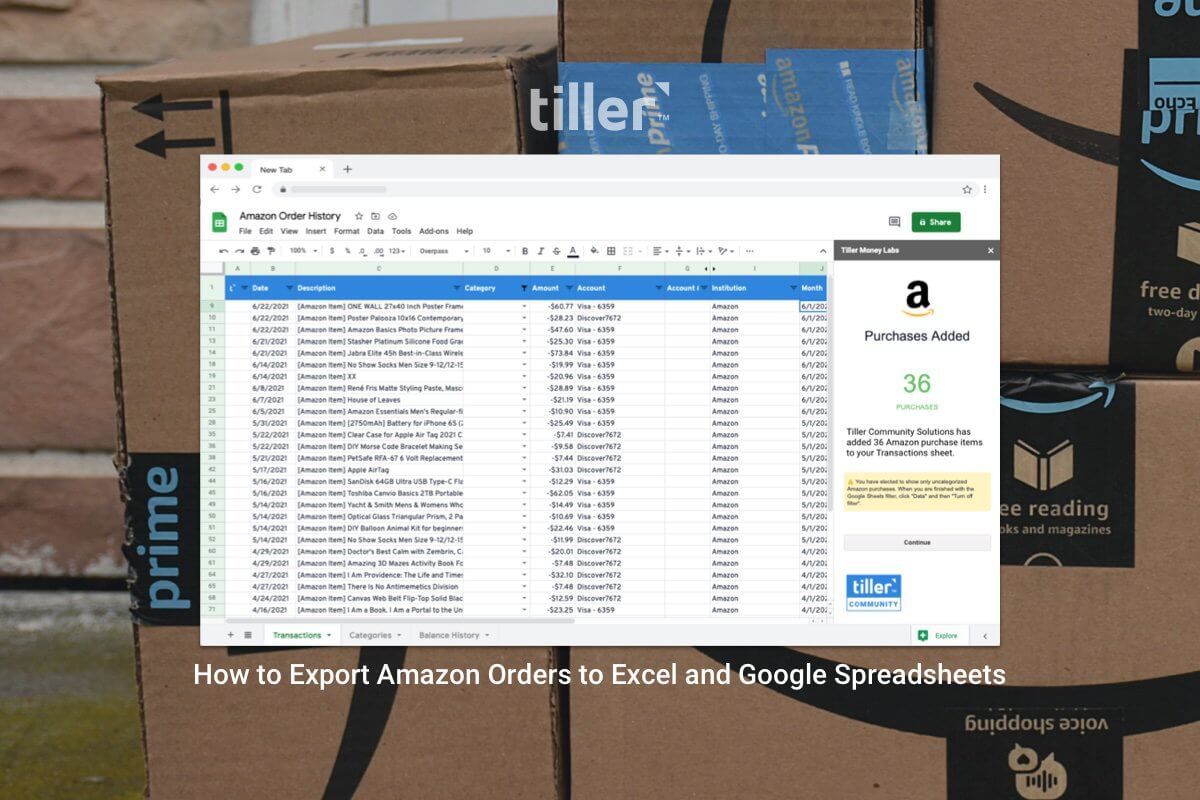

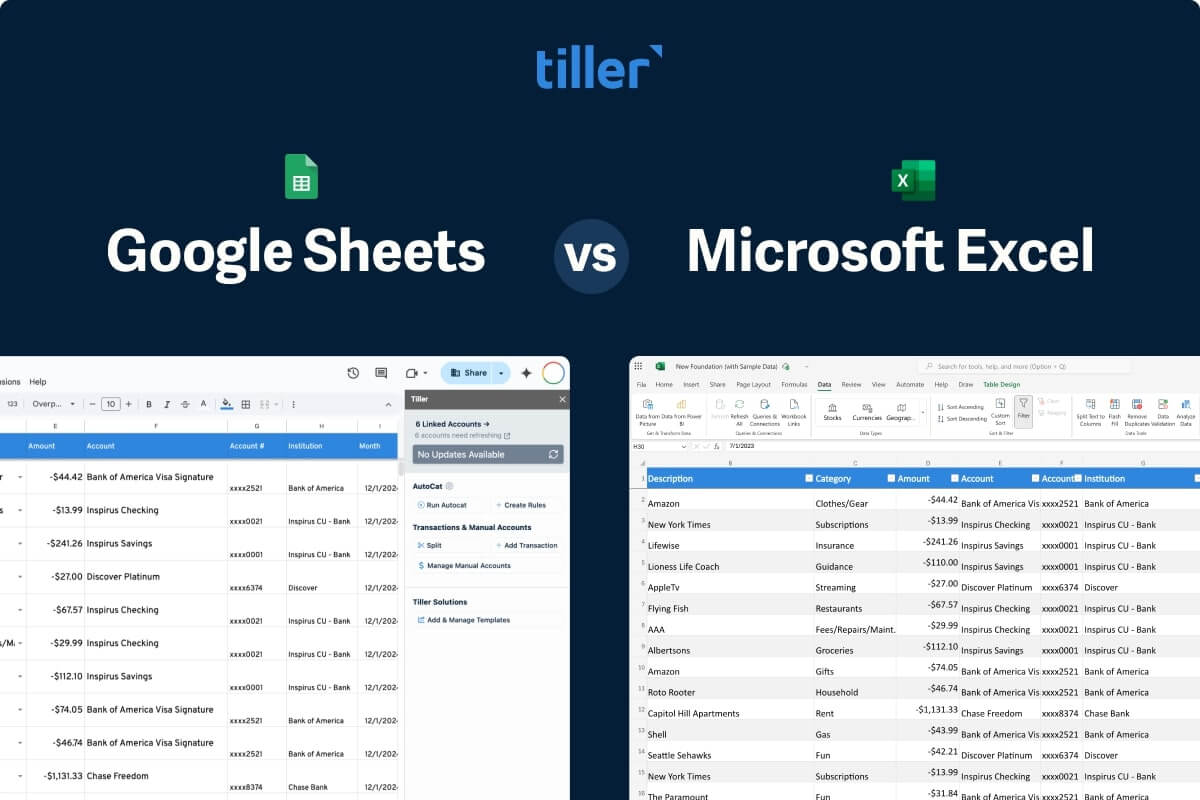

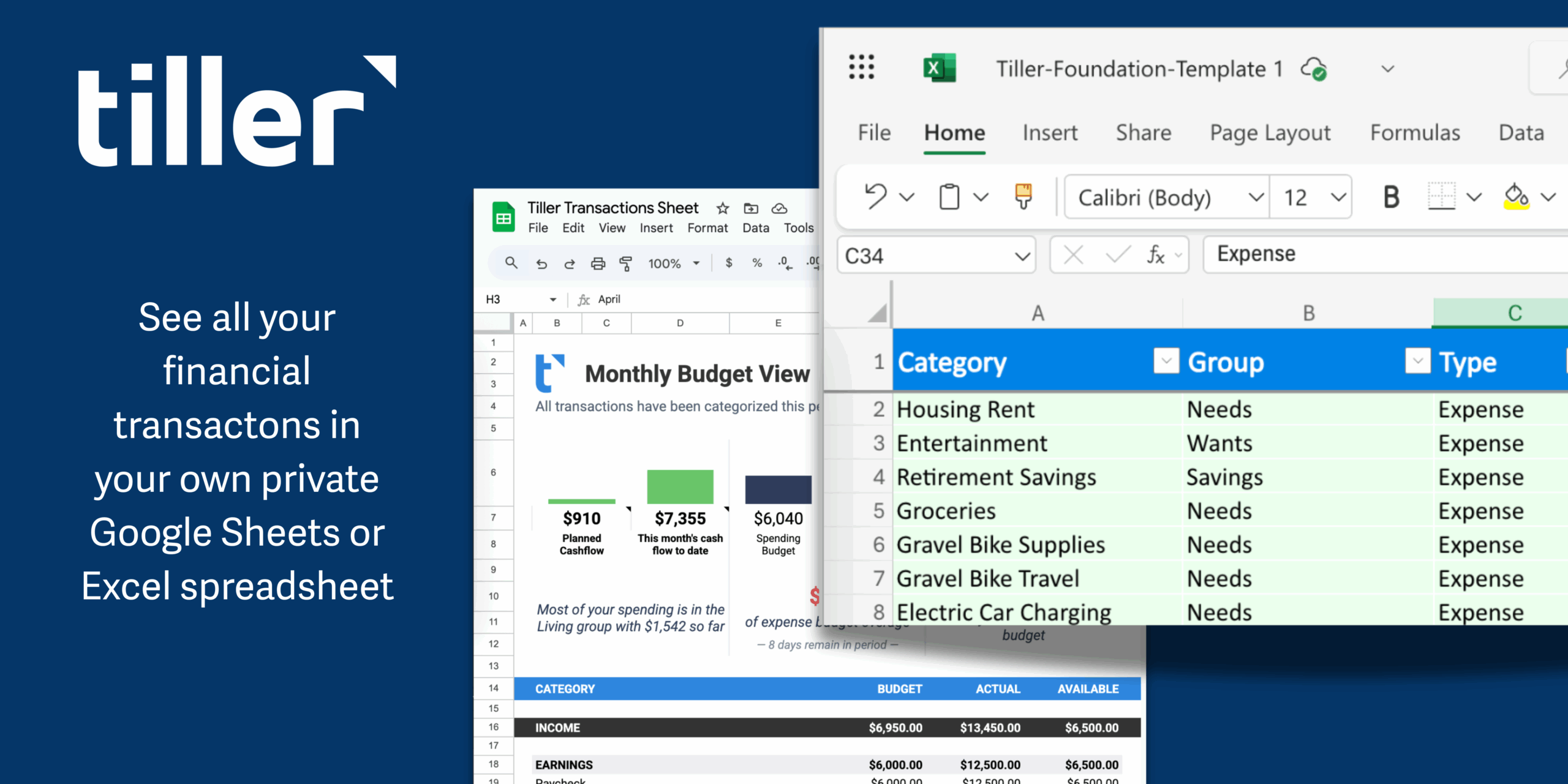

This is precisely the job Tiller was built to do. By securely linking to all your financial accounts, Tiller automatically feeds your daily spending, income, and balances into a flexible, private spreadsheet in Google Sheets or Microsoft Excel. The feature is the automated data feed, but the benefit is profound: you get a single, always up-to-date view of your entire financial life without hours of manual data entry. This effortless clarity is the first and most crucial step toward feeling prepared and in charge.

Way #2: Reframe “Unexpected” Expenses with Sinking Funds

The term “unexpected expense” is often a misnomer. Your car will need new tires. Your pet will need to go to the vet. Your refrigerator will eventually break down. These events are not truly unexpected; they are simply irregular. The dread they inspire comes from their timing, not their inevitability.

The solution is to transform these predictable surprises into manageable monthly line items using a simple but powerful tool: the sinking fund.

From Surprise Bills to Predictable Inconveniences

A sinking fund is a dedicated savings account for a specific, non-monthly expense. Instead of being blindsided by a $1,000 bill for new brakes, you systematically save a small amount each month. By doing this, you smooth out the financial peaks and valleys of your year, turning a potential crisis into a planned-for inconvenience.

A sinking fund is a dedicated savings account for a specific, non-monthly expense. Instead of being blindsided by a $1,000 bill for new brakes, you systematically save a small amount each month. By doing this, you smooth out the financial peaks and valleys of your year, turning a potential crisis into a planned-for inconvenience.

Giving your money a specific job before you spend it is one of the most effective ways to align your actions with your intentions. It’s a proactive strategy that puts you in the driver’s seat.

How to Start Your First Sinking Fund

Getting started is simpler than you might think. Follow these steps:

- Choose One Expense That Causes Dread. Don’t try to plan for everything at once. Pick the one irregular expense that worries you most. For many people, this is car maintenance.

- Estimate the Annual Cost. Do a rough calculation. How much do you spend on oil changes, new tires, and other routine maintenance in a year? Add an estimate for one moderate repair. Let’s say you land on a total of $1,200 for the year.

- Calculate Your Monthly Goal. Divide the annual cost by 12. In this example, $1,200 divided by 12 is $100. This is your monthly savings target for your “Car Repair” sinking fund.

- Automate and Track. The easiest way to ensure success is to automate it. Set up a recurring monthly transfer of $100 from your checking account to a dedicated high-yield savings account.

When you use Tiller, you can take this a step further. You can create a specific category in your spreadsheet for your “Car Repair Fund.” Every time your $100 transfer happens, you categorize it. This allows you to watch your fund grow month by month, providing powerful visual motivation and reinforcing your new habit. When the inevitable repair bill arrives, you can pay it without stress, knowing the money is already set aside and waiting.

Way #3: Align Your Spending with Your Values

A common fear is that looking closely at your money means you’ll have to stop spending on things you enjoy. The reality is often the opposite. Gaining clarity isn’t about forced restriction; it’s about making conscious choices. It empowers you to direct your money toward what truly matters to you and cut back on the things that don’t. This is the heart of intentional spending. It reflects a core Tiller value: Money matters because life matters more. Your money should be a tool to build the life you want.

It’s Not About Cutting, It’s About Choosing

When you have a clear, centralized view of your transactions, you can finally see where your money is actually going. This is often an eye-opening experience. You might discover “spending leaks.” Money flowing to things that provide little value or happiness. These could be forgotten subscriptions, daily coffees you barely remember, or impulse online purchases.

Identifying these leaks isn’t a reason for guilt. It’s an opportunity. Every dollar you reclaim from unintentional spending is a dollar you can redirect toward a goal that excites you, whether that’s a vacation, a down payment on a home, or simply the peace of mind that comes from a healthy emergency fund.

This process transforms budgeting from a negative exercise of what you can’t have into a positive exercise of what you want to have. You’re not cutting back; you’re making deliberate trade-offs. You might happily give up a few takeout meals a month to fund a weekend camping trip, because the experience of the trip aligns more closely with your values. Seeing your spending clearly in a spreadsheet gives you the data you need to make these value-based choices with confidence.

Way #4: Understand the Long-Term Cost of Monthly Payments

Our brains are wired to favor short-term relief, which can make a low monthly payment seem incredibly attractive. This is the illusion that fuels the cycle of debt. The person who trades in their car to avoid a repair isn’t just thinking about the money; they are trying to escape the immediate stress and fatigue of a difficult decision. However, understanding the true, long-term cost of that “easy” monthly payment is a critical step in breaking free.

The Illusion of the “Affordable” Monthly Payment

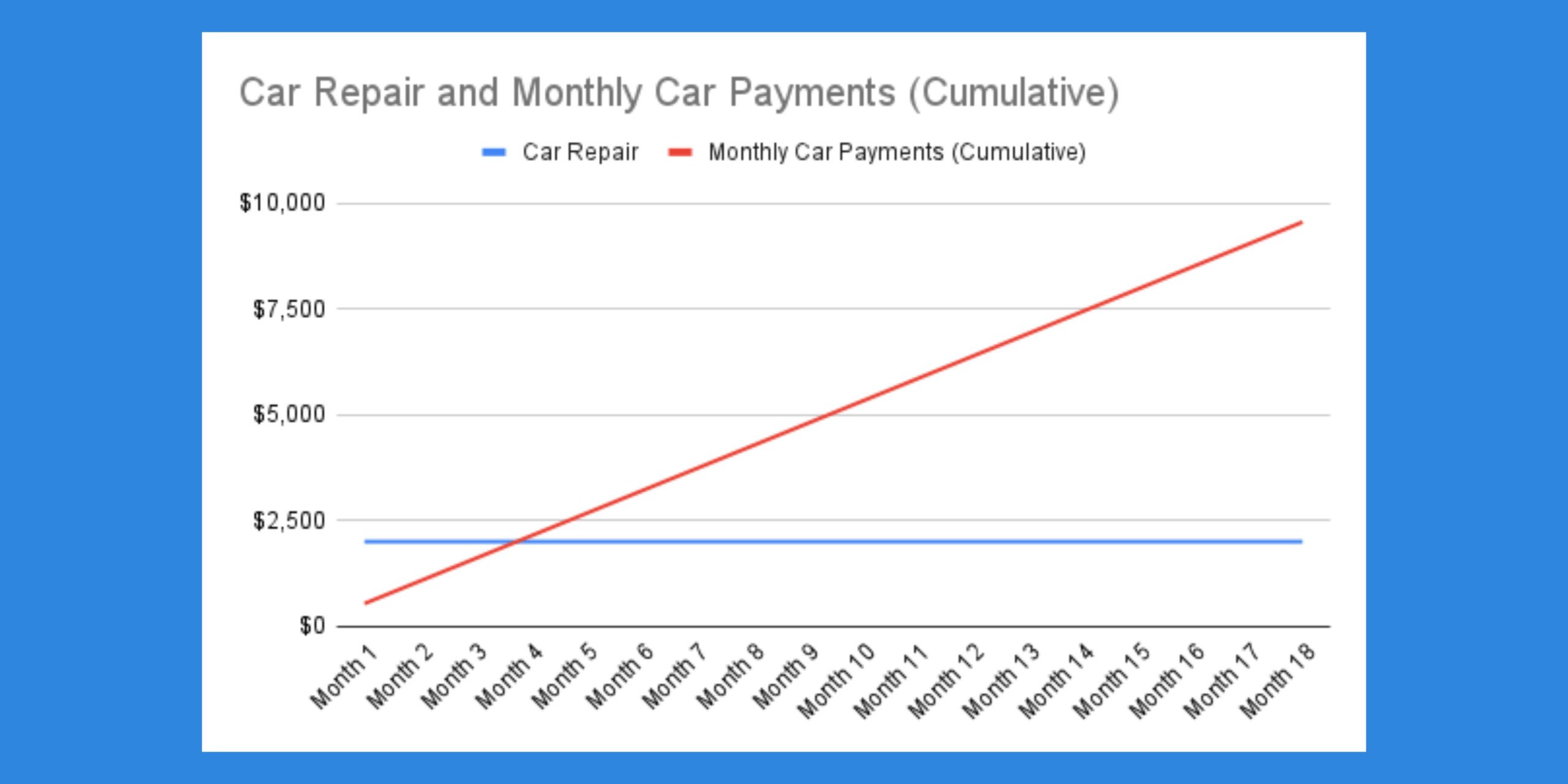

Let’s return to the car example and look at the real numbers.

- Option A: The Repair. You pay a mechanic $2,000 to fix your paid-off car.

- Option B: The New Loan. You trade in your car and take out a $27,000 loan for a used vehicle. With an average used car interest rate of 11.87% over a 67-month term, your monthly payment would be around $521.

The $521 monthly payment might feel manageable, but let’s look at the total cost. Over the life of the loan, you will pay approximately $34,907 for that car. That’s nearly $8,000 in interest alone. The $2,000 repair, while painful in the moment, is vastly cheaper in the long run.

This doesn’t even account for the opportunity cost. What else could that $521 a month have done for you? Over 67 months, it could have become a powerful down payment on a house, a fully funded retirement account, or the seed money for a small business.

Using Your Data to Make Better Debt Decisions

When you have clarity over your entire money picture, you can model how a new long-term payment will impact your life. You can see that adding a $521 monthly payment means you can no longer save for your vacation or contribute as much to your retirement. A spreadsheet allows you to visualize these trade-offs clearly, shifting the decision from an emotional, short-term reaction to a logical, long-term evaluation. This clarity gives you the confidence to choose the path that, while harder in the moment, builds a more secure and prosperous future.

Way #5: Put Your Plan on Autopilot to Reduce Decision Fatigue

The average person makes about 35,000 decisions a day. This constant mental effort leads to a well-documented psychological phenomenon called “decision fatigue.” The more choices we make, the more our ability to make good ones deteriorates, leading us to favor impulsive, short-term options. Financial stress significantly worsens this fatigue, making it even harder to manage money effectively. One of the most powerful ways to combat this is through automation.

Building a System That Works For You

Instead of relying on willpower to make dozens of good money choices every week, build a system that makes those choices for you automatically. By setting up recurring transfers, you remove the daily debate about whether to save or spend.

You can automate:

- Bill Payments: Ensure your essential bills are always paid on time.

- Sinking Funds: Automatically move money into your dedicated savings accounts for car repairs, vacations, or home maintenance.

- Retirement contributions: Pay your future self first by contributing to your 401(k) or IRA with every paycheck.

The best time to do this is right after you get paid. By moving your savings and investment money before you have a chance to spend it, you create a system where you are building wealth and preparing for the future in the background, without any additional mental effort.

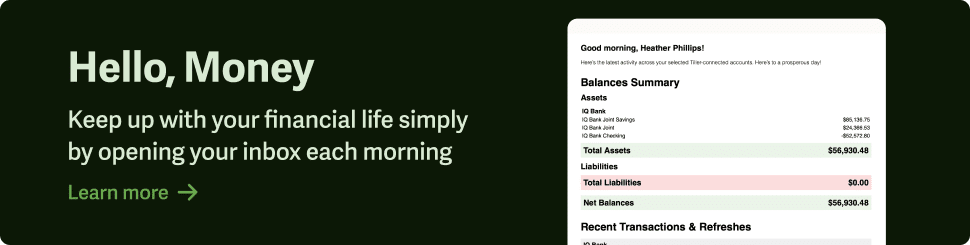

This strategy reduces decision fatigue and creates an environment where your financial goals are the default. And with a tool like Tiller, you can easily monitor this automated system. The daily “Hello, Money” email summary provides a quick, reassuring check-in, confirming that your plan is working as designed. It’s the perfect balance of automation and engaged awareness, helping you stay on track without feeling overwhelmed.

From Dread to Confidence

Beating the dread of future bills is a journey, not a destination. It begins with the decision to seek clarity instead of avoiding uncertainty. By seeing your entire financial picture, reframing expenses with sinking funds, spending with intention, understanding the true cost of debt, and automating your plan, you fundamentally change your relationship with money.

You move from a reactive, month-to-month mindset to a proactive, long-term perspective. You replace anxiety with a plan, and you replace dread with the quiet confidence that comes from knowing you are prepared for whatever lies ahead. Start with one small step today.