A complete financial plan is more than a budget. Understanding your potential taxes is a key part of it. Use the 2025 tax estimator below to get a quick projection of what you might owe or be refunded.

🛡️Your Privacy is Our Priority.

This calculator is for you, and you alone. At Tiller, we do not collect, save, or share any of your personal financial data. Ever. You are not opted into marketing

For entertainment and educational purposes only. This calculator provides a simplified estimate based on standard inputs and does not constitute tax advice. Tax laws are complex and your situation is unique. Please consult a qualified tax professional for advice specific to your circumstances.

Then let Tiller automate the rest of your financial picture. Tiller automatically feeds all your daily spending, balances, and transactions into a private spreadsheet so you can build your tax projection into a real, comprehensive budget.

Use Tiller to Plan for Tax Time with Confidence, No Matter How You File

As the most flexible budget application, Tiller gives you a powerful advantage for tax preparation. We automatically update a private spreadsheet with every transaction from your linked accounts each day. This complete financial record allows you to precisely track income, categorize every potential deduction with AutoCat, and build custom reports so you have a clear, accurate picture of your finances long before tax season begins

For Your Personal Finances

Get a complete and accurate record of your financial year. Use Tiller to automatically categorize all your transactions, from charitable donations to medical bills. With a clear view of your spending, you can easily spot potential deductions and plan with your actual numbers, not just guesses.

For You and Your Partner

Combine your financial data into one shared spreadsheet for a single source of truth. When you and your partner have a clear, collaborative view of your joint income, spending, and savings, preparing to file together becomes a simple and transparent process.

For Your Side Hustle or Small Business

Tiller is the only finance tracking application that allows you to manage both your personal finances and your side hustle with the same subscription. Create custom categories to easily tag business expenses, track different income streams, and monitor your profitability. At tax time, you have a clean, clear report of your business activity, completely separate from your personal spending.

From Estimate to Action

Your tax estimate is a snapshot, the final score of a year’s worth of financial decisions. But to truly take control and improve next year’s outcome, you need to see the full story behind that number. A simple estimate can’t tell you if you overspent on subscriptions, missed a crucial tax deduction, or how much closer you are to your savings goals.

Answering these questions is the difference between reacting to your finances and actively planning them. This is where Tiller automates the full picture for you. By connecting directly to your accounts, Tiller gives you a perpetually current and completely private spreadsheet with every transaction. With no more manual entry and no more guessing, you get a clear, accurate view of your financial life.

Explore Popular Tiller Templates

Your Tiller subscription unlocks a powerful gallery of community built templates. Go beyond basic budgeting and install these popular tools to gain deeper insight into your finances.

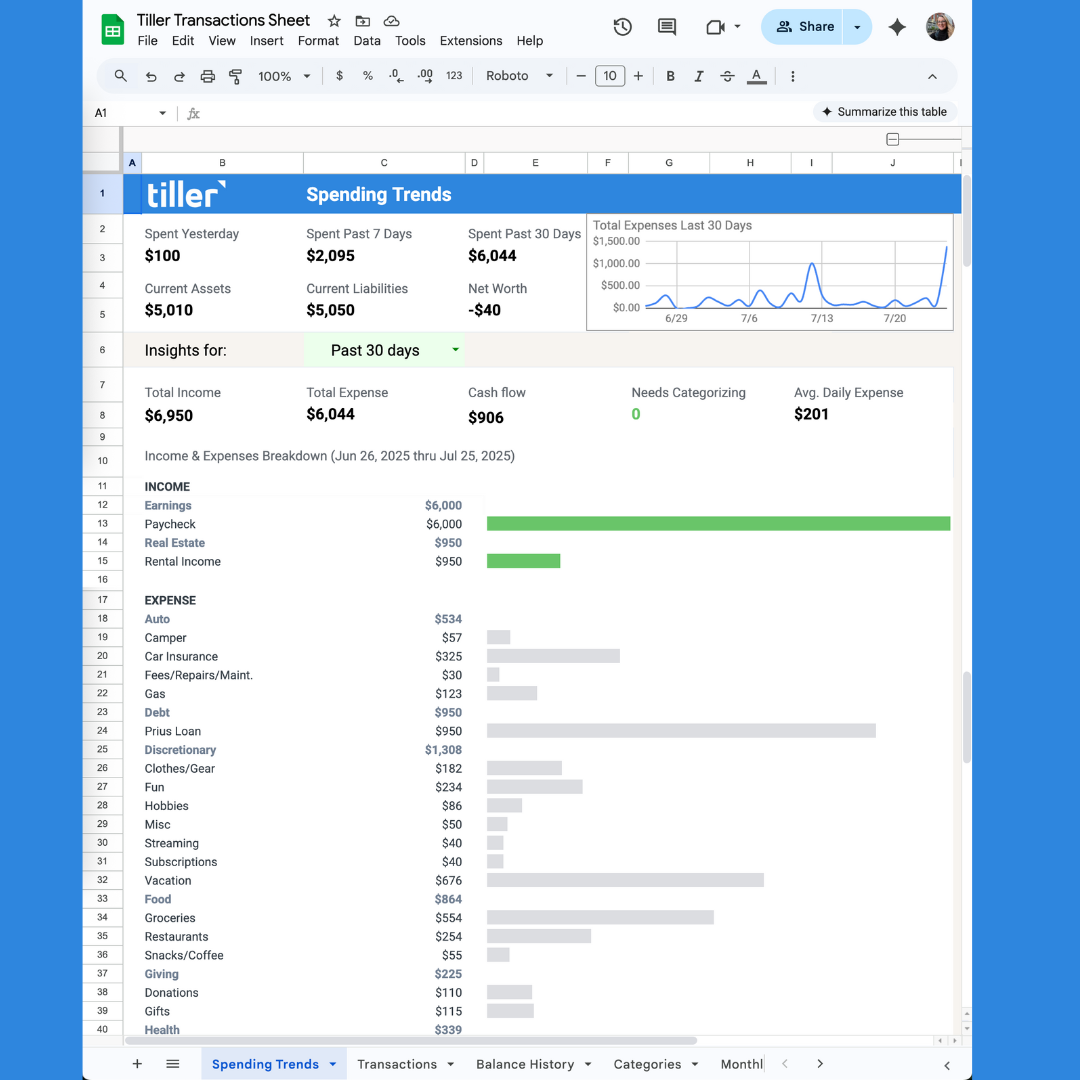

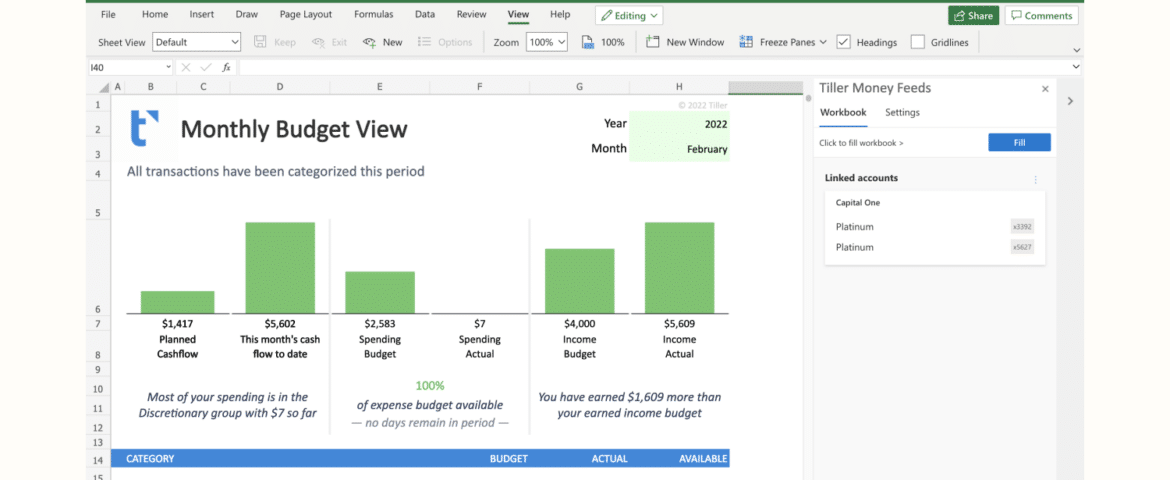

The Foundation Template

Gain a clear view of your money with the Foundation Template, the powerful dashboard included with your Tiller subscription. It provides the clarity and tools to build a flexible budget your way, helping you align your spending with what matters most.

The template comes ready with several core tabs. See all your transactions from every linked account in the Transactions tab and manage your custom spending and income groups in the Categories tab. You can plan your spending and track your progress with the Monthly and Yearly Budgets, while the Spending Trends tab gives you a visual overview of where your money is going.

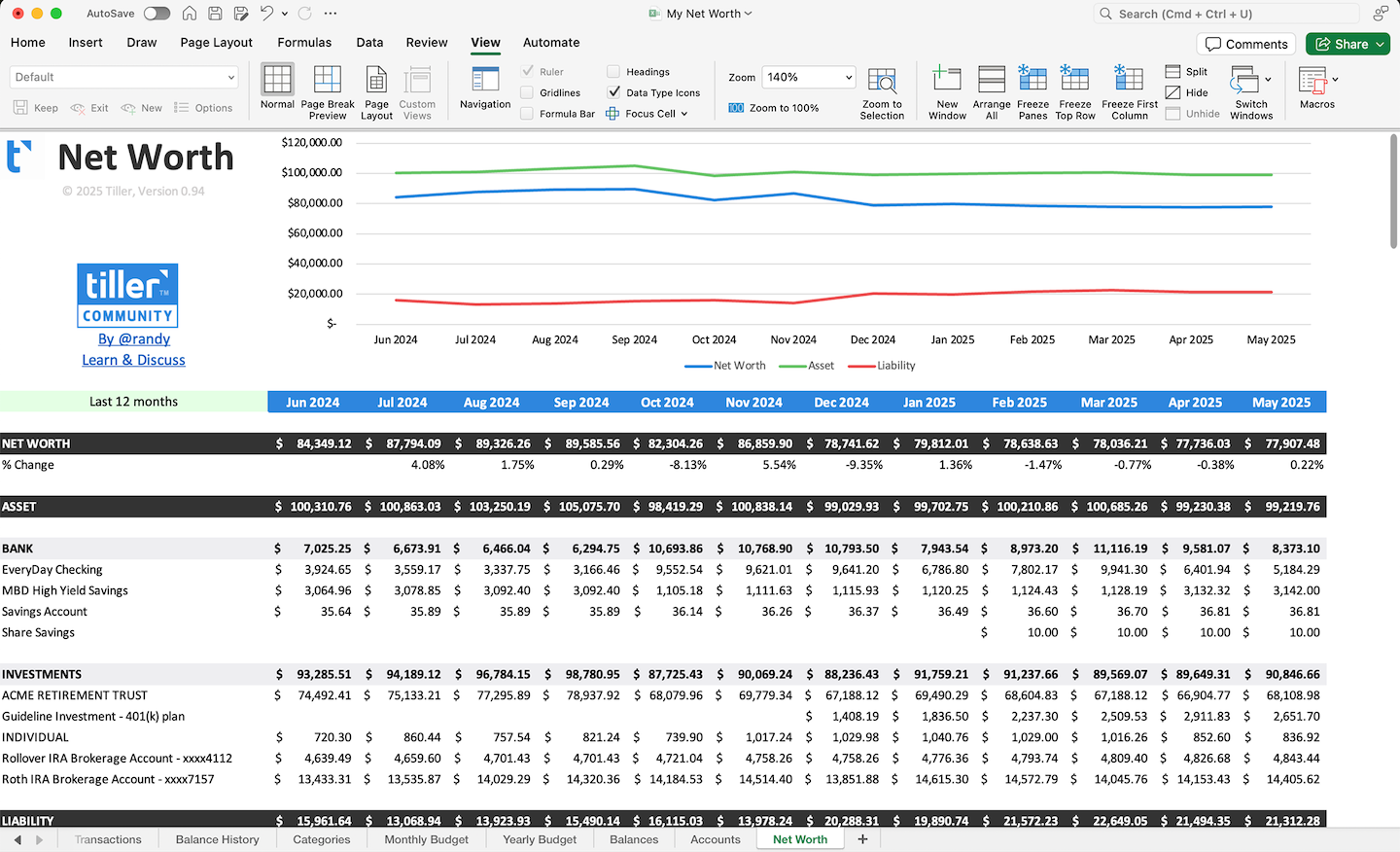

Net Worth Tracker

Your tax bill is about your income, but your net worth is about your progress. The Net Worth Tracker template automatically tracks the value of your assets (like savings, investments, and property) against your liabilities (like loans and credit card debt) to give you a clear, motivating view of your total financial health over time.

Yearly Budget

See your financial year the way the IRS does. This template allows you to look beyond monthly spending and view your cash flow on an annual basis. You can see how your income, major expenses, and savings rate are trending over the entire year, making it easier to plan for big goals and anticipate your tax liability long before the filing deadline.

Debt Snowball Calculator

If paying down debt is a priority, the Debt Payoff template is essential. It helps you organize your loans and credit cards, experiment with different payoff strategies (like the debt snowball or avalanche methods), and visualize your path to becoming debt free. See exactly how extra payments can accelerate your progress and save you money on interest.