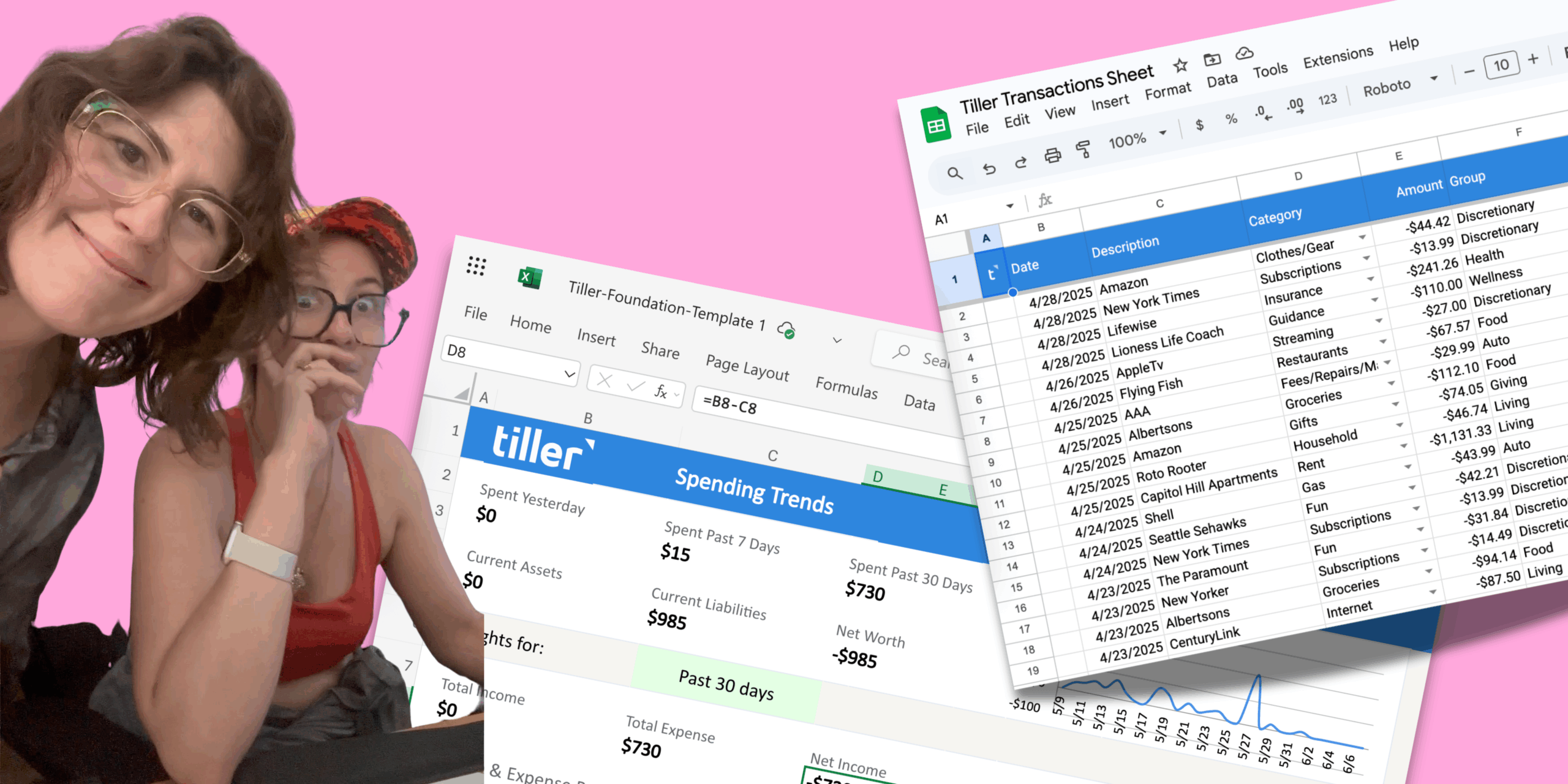

Tiller is thrilled to announce a new partnership with the critically acclaimed podcast, Debt Heads. This collaboration is special, rooted in authentic, shared values. The podcast’s hosts, Jamie Feldman and Rachel Webster, are not just brilliant storytellers; they are longtime, avid Tiller users.

Peter Polson, CEO of Tiller, shared his excitement about the partnership:

“We love what Jamie and Rachel are doing with Debt Heads by helping people feel seen and supported as they work toward financial confidence. At Tiller, we believe money is personal, and we’re excited to partner with voices who are making that conversation more honest, relatable, and real.”

— Peter Polson, Founder & CEO of Tiller

This partnership is a natural extension of our core missions. Debt Heads masterfully explores the “why” of money: the complex histories, cultural forces, and systemic pressures that shape our financial lives. Tiller provides the “what”: the clear, personal, and real-time data that empowers you to navigate those systems.

We believe that true financial confidence is born from this combination. It comes from understanding the world you live in and having the personal clarity to find your own path through it. We are proud to support the essential, non-judgmental conversations that Jamie and Rachel are leading.

Introducing Debt Heads: A New Conversation About Money

Debt Heads is a narrative documentary podcast that launched in March 2025 with a clear and ambitious goal: “turning the concept of debt upside down.”

This is not another show about “debt payoff hacks” or rigid budgeting tips. It is a deeply researched, journalistic investigation into the systems, history, and culture that created our modern relationship with debt. Hosts Jamie Feldman and Rachel Webster are engaging, funny, and personable storytellers who move beyond the shame-based narratives that dominate personal finance.

Human Stories, Not Financial Lectures

What makes the podcast so compelling is its tone. Listening to Debt Heads feels like sitting in on a candid conversation between friends. Jamie and Rachel are guides on a shared journey of discovery. They explore their own financial lives with vulnerability, which in turn gives listeners permission to examine their own stories without judgment.

“Listening to Debt Heads is delightful. Jamie and Rachel are personable, funny, and great storytellers. I’m excited to share this fantastic resource with Tiller’s audience.” – Chris Rodde, Tiller CMO

Understanding the “Why” of Debt

The show’s real power comes from its deep dive into the history of debt. The hosts trace the massive structural shifts in the American economy that shaped our current reality. They ask why so many people feel overwhelmed by debt and why the American dream feels so elusive for so many.

They tell the story of how we got here… going way back to before we had credit cards and how nobody had debt essentially before the mid 80s, outside of their home mortgage.

The Systemic Shift: How Debt Became American

Debt Heads explores what happened next. The podcast details the deregulation of the banking industry in the 1980s. This policy change, combined with innovations in marketing and technology, unleashed a torrent of consumer credit.

The hosts explain how banks were suddenly able to market credit cards across state lines through massive direct mail campaigns. An entire industry was born, and with it, a new culture. The show explains how consumer debt went from being a rare financial tool to a normalized part of American life.

Exploring the Culture of Spending

The podcast also wisely investigates the cultural side of the equation. It is not just about policy; it is about identity. In one memorable segment, the hosts describe a day spent shopping with family. The story illustrates how consumerism is not just about acquiring goods. It is a ritual. It is a way to bond, a form of entertainment, and for many, a way to express identity and love.

By exploring the culture of spending, Debt Heads helps listeners understand the powerful social and emotional forces that influence their financial decisions.

From Personal Blame to Systemic Context

This is the central theme of the podcast. Debt Heads masterfully shifts the conversation from individual blame to systemic context. Listeners who may feel personal shame about their debt can suddenly see a larger picture. They can understand that their financial stress is not a moral failing. It is, in many ways, a rational response to a complex system that is built to encourage debt and consumption.

This knowledge is profoundly empowering. It dismantles shame and replaces it with understanding.

An Authentic Partnership: The Debt Heads Tiller Story

This partnership is a perfect philosophical match precisely because it is authentic. The hosts of Debt Heads chose Tiller as their own financial tool long before any formal relationship existed. Their journey illustrates the TIller philosophy in action.

The Moment of Clarity

Jamie and Rachel’s Tiller story is a perfect example of Tiller’s purpose. As they describe it:

“Tiller has been integral to the Debt Heads journey since day one when Rachel marched Jamie into her office, forced her to log into Tiller, and guided her through a long-overdue and highly emotional spending audit.”

This is the moment of clarity. That first look at the complete, unvarnished picture can be emotional. It can be intimidating. But it is the necessary first step toward gaining control. It is the moment you stop guessing and start knowing.

Why Tiller? Control Without Judgment

The Debt Heads team specifically chose Tiller over other tools because our philosophy matched their needs. They explain:

“Tiller helps people take control of their finances without judgment or shame, it’s user-friendly and exceeds every other budgeting programs we’ve ever used.”

This distinction is the key. Tiller is a tool for gaining insight, not a system for enforcing dogma. We believe our customers are smart and sophisticated. They do not need to be talked down to or forced into a one-size-fits-all box. They need reliable data and flexible tools to build their own solutions.

The Human Element in a Digital World

The hosts’ experience also highlights the human side of our brand. In a world of increasing automation, Tiller remains committed to genuine, helpful human interaction.

We are incredibly proud that their experience reflects our internal values. They note that Tiller is “genuinely devoted to its community.” In a world of chatbots and virtual attendants, Tiller provides support from real, solutions-focused humans. As the hosts put it:

“Tiller feels like more than a budgeting app, it’s a model for how to treat your customers.”

The Right Tool for the Job

The most authentic endorsement of all is one that acknowledges the reality of managing money. Budgets are not always fun. Facing your spending is not always happy. The hosts capture this perfectly:

“Tiller is a service we genuinely use and we love it so much that we happily sing its praises to everyone we know, even when we’re not happy about our actual budgets!”

This perfectly separates the tool from the feeling. The Tiller spreadsheet is the source of clarity, regardless of what the numbers say. That clarity is what allows you to make a new plan.

What is Tiller? The Foundation of Personal Financial Clarity

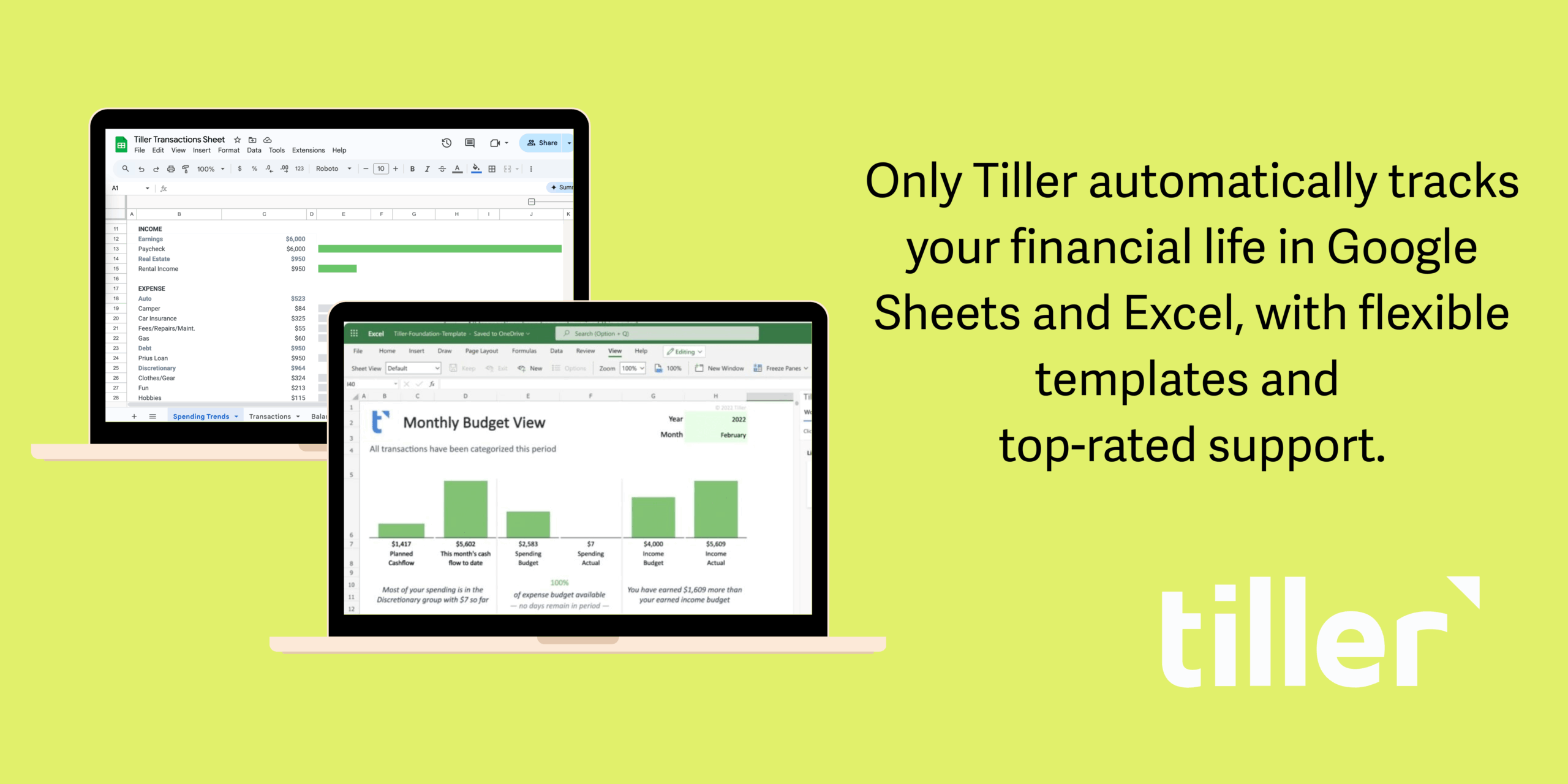

For Debt Heads listeners who may be discovering us for the first time, it is important to understand what Tiller is and what makes us fundamentally different.

A Fundamentally Different Approach

Tiller is not another rigid financial app. We built our service on a simple premise: you should own your financial data and manage it your way.

Many financial apps are “black boxes.” They force you into predefined categories, hide their calculations, and often operate on an ad-based model where your personal data is the product. Tiller rejects this model.

We are an ad-free, customer-funded service. Our only priority is serving you, our subscriber.

The Power of Ownership and Flexibility

Tiller’s core service is Tiller Money Feeds. This powerful engine automatically imports your daily spending, balances, and transactions from over 21,000 financial sources directly into your own private spreadsheets in Google Sheets and Microsoft Excel.

This single function solves the most tedious part of managing money: manual data entry. It provides a clean, reliable, and complete view of your financial life, automatically updated for you every day.

Customization Means Control

From this foundation of clean, automated data, the power shifts entirely to you. We champion spreadsheets because they are the most flexible and powerful personal finance tools ever created.

Tiller provides a suite of robust, pre-built templates to get you started in minutes. Our popular Foundation Template offers a comprehensive system for budgeting, tracking expenses, and viewing your net worth. But this is just the beginning.

You are never locked into one person’s idea of “the right way” to budget. You can track what you want, how you want. You can build a completely custom dashboard from scratch. This ultra-customizable approach, the very one chosen by the Debt Heads hosts, ensures that your financial tool can grow and adapt with you.

Join the Conversation

We are thrilled to support Debt Heads as they tell this essential story. We encourage the entire Tiller community to listen. Their work provides the “why,” and Tiller provides the “what.” We believe that combination is exactly what people need to build a better financial future.

How to Listen

You can listen to Debt Heads on Apple Podcasts, Spotify, or wherever you get your podcasts. You can also learn more on their website at debtheadspodcast.com and follow them on Instagram @debtheadspodcast.

A Final Thought

This partnership is a celebration of shared values. Debt Heads is more than a podcast about money. It is a conversation about history, culture, and humanity. Tiller is more than a budgeting app. It is a tool for clarity, ownership, and control.

We are proud to support this work and even prouder that its hosts are part of our Tiller Community. We hope you will join us in listening.