Start Your Free Trial

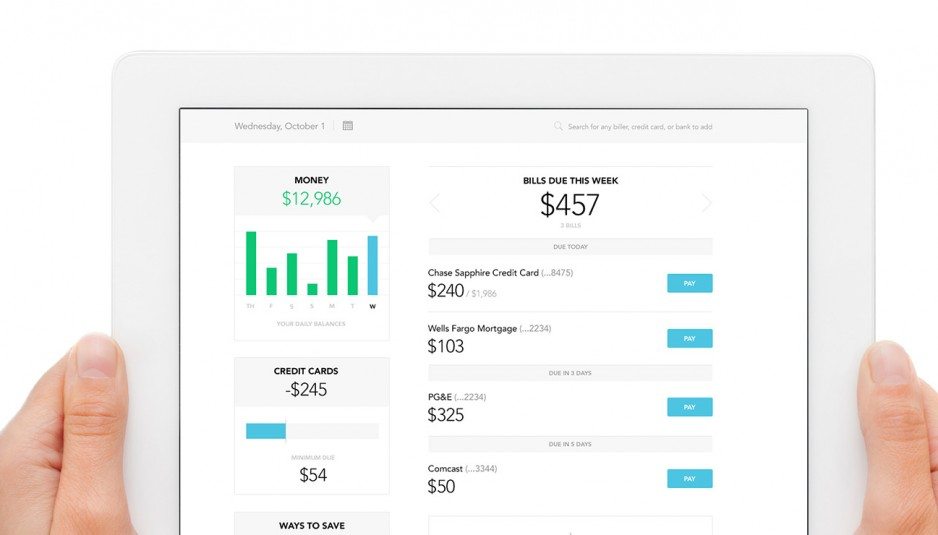

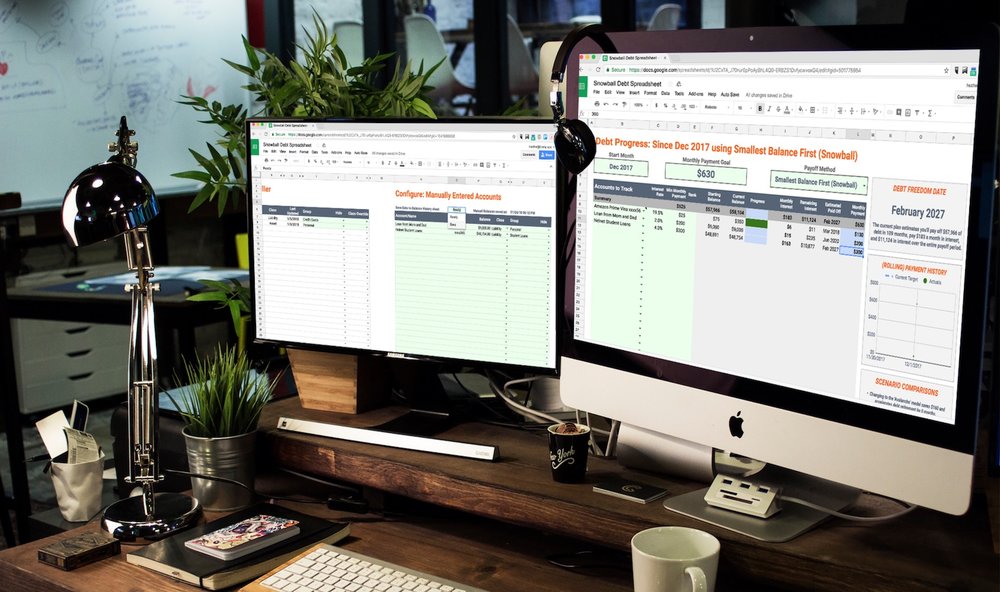

Keep a clear, confident view of all your money in one place, with flexible templates, powerful privacy, and top-rated support

"There isn’t another tool on the market that does what Tiller can do.”

Will Hinton, Google Review October 30, 2023