The idea of “free money” sounds like a myth, a late night television offer that’s too good to be true. But it’s not about windfalls or get rich quick schemes. It’s about discovering the money you already have. It’s about unlocking the hidden potential within your own budget, making small, intentional changes that add up to significant savings. This isn’t about restriction; it’s about awareness. When you have a clear picture of where your money goes, you can align your spending with your values and goals. You gain clarity. Suddenly, you find pockets of cash you didn’t know you had. It feels like getting a raise without having to ask for one.

A Practical Guide to Uncovering the Money You Already Have

Gaining this level of financial clarity often starts with seeing all your transactions and balances in one place. When your financial life is automatically updated each day in a flexible spreadsheet, you can stop guessing and start knowing. You can customize it, because your approach to money is unique. This guide will walk you through 25 actionable ways to uncover that ‘free money.’ These are not drastic life overhauls. They are practical, manageable steps designed to put cash back into your wallet, ready for you to put toward what truly matters to you.

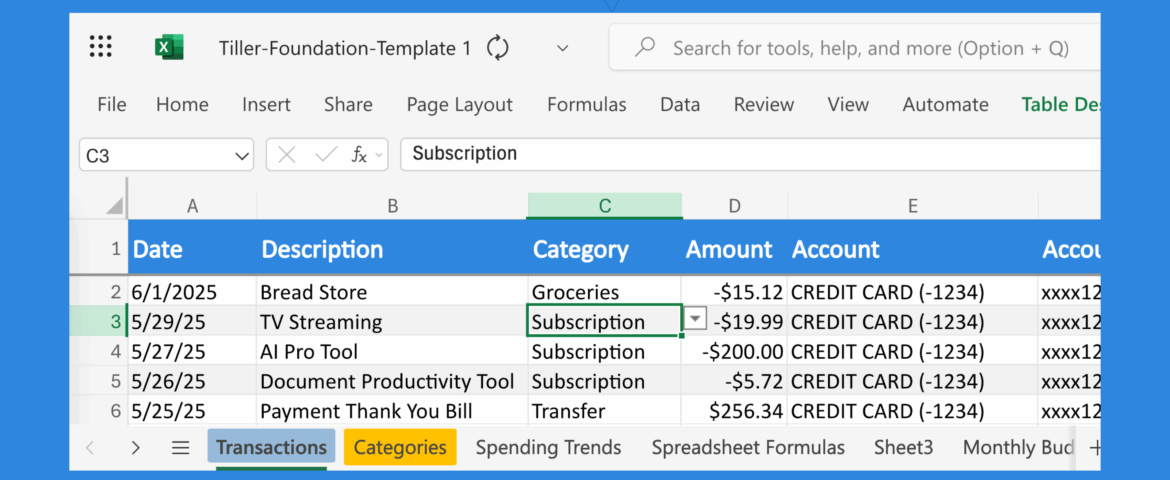

1. Conduct a Subscription Audit

This is the number one source of found money for a reason. We live in a subscription economy, and those small monthly charges for streaming services, apps, and subscription boxes add up. The first step is to see them all. When you have a tool, such as Tiller, that automatically pulls all your daily spending into a single spreadsheet, you can quickly scan for recurring charges and determine which subscriptions to cancel. You will likely find services you forgot you signed up for or no longer use. Make a list, check in with your household to see which ones are still providing value, and be ruthless about canceling the rest. That $15 a month you save is $180 a year back in your budget.

2. Automate Your Savings

Pay yourself first, but make it automatic. This is the simplest way to ensure you are saving money consistently. Set up an automatic transfer from your checking account to your savings account the day you get paid. Even if you start with just $25 per paycheck, you are building a habit. When the money is moved before you have a chance to spend it, you won’t even miss it. This method prioritizes your financial goals and treats saving as a non negotiable expense. A clear financial dashboard can help you see your savings balances grow, which provides powerful motivation to continue or even increase the amount.

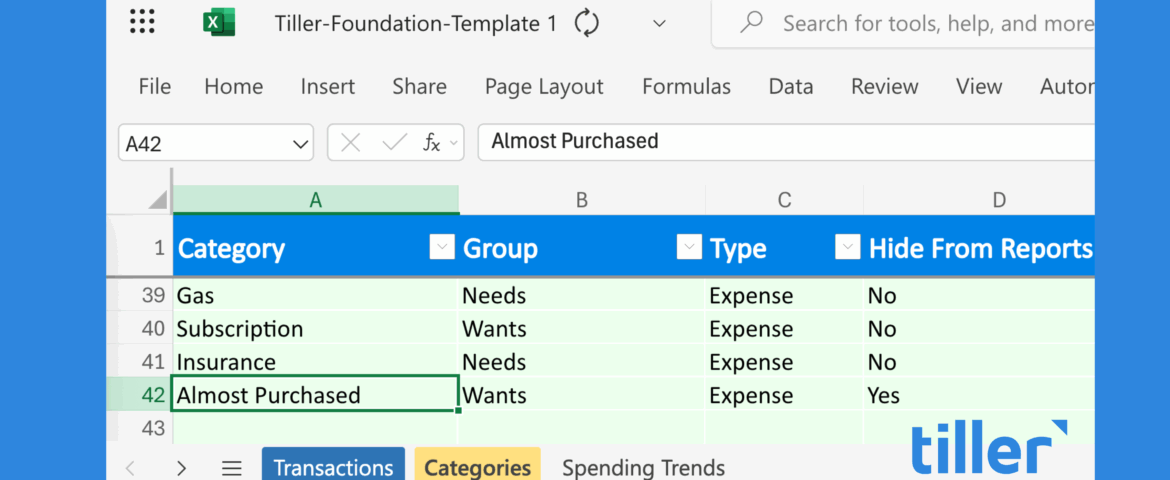

3. The 48 Hour Rule

Combat impulse spending with a mandatory waiting period. For any non essential purchase over a certain amount, say $50, commit to waiting 48 hours before you buy it. This cooling off period separates a genuine need from a fleeting want. More often than not, the urge to buy will pass, and you will realize you didn’t need the item after all. Track these “almost purchases” in a spreadsheet. Seeing how much you have saved by simply waiting can be incredibly rewarding. It is a powerful exercise in intentional spending.

4. Master Your Grocery Budget

Food is a major expense category for most households, and it is ripe with savings opportunities. Start by planning your meals for the week. Create a shopping list based on your meal plan and stick to it. This simple habit prevents impulse buys and reduces food waste. Another tip is to shop with a full stomach; you are less likely to buy items off the shopping list. Additionally, look at the price per unit to compare different sizes and brands accurately. Having a detailed view of your grocery spending from week to week allows you to identify patterns and find new ways to trim costs without sacrificing quality.

5. Refinance High Interest Debt

High interest debt, especially from credit cards, can feel like a financial anchor. The interest payments are essentially “free money” you are giving to the bank. Look into options for debt consolidation or refinancing. This could mean transferring your balance to a credit card with a zero percent introductory offer or taking out a personal loan with a lower interest rate to pay off your credit cards. The goal is to reduce the amount of interest you are paying so more of your payment goes toward the principal balance. This can save you thousands of dollars and help you get out of debt faster.

☃️ Check out these “6 Favorite Free Debt Snowball Spreadsheets for 2025“

6. Negotiate Your Bills

Many of your recurring monthly bills are not set in stone. You can often negotiate a better rate for services like your cell phone, cable, and internet. Call your providers and ask if you are on the best plan for your needs or if there are any new promotions available. Mentioning that you are considering switching to a competitor can often unlock discounts. The same goes for insurance premiums. A few phone calls once a year can lead to hundreds of dollars in savings. It is a small investment of your time for a significant return.

7. Uncover “Vampire” Energy Costs

Vampire energy, the power that electronics draw even when they are turned off, can quietly drain your budget. Unplug chargers, televisions, and other appliances when they are not in use, or connect them to a power strip that you can easily switch off. Simple changes like switching to LED light bulbs and ensuring your home is properly sealed and insulated can also lead to big savings on your utility bills. Analyzing your energy bills month over month can help you see the impact of these changes.

8. DIY Instead of Buying New

Before you replace a wobbly chair or a scuffed table, consider if you can repair or refurbish it yourself. A little wood glue, a coat of paint, or new hardware can often breathe new life into old furniture for a fraction of the cost of buying new. The same principle applies to clothing with a missing button or a small tear. Learning a few basic repair skills from online videos can save you a surprising amount of money over time and reduce waste.

9. Review Your Insurance Policies

Insurance is a necessity, but you might be paying more than you need to. Review your policies for auto, home, and renters insurance annually. Your needs may have changed, or you might qualify for new discounts. Bundling your policies with a single provider often results in a significant discount. Don’t be afraid to shop around and get quotes from multiple companies. A little bit of research can ensure you have the right coverage at the best possible price.

10. The No Spend Challenge

Challenge yourself to a “no spend” weekend or even a full week once a quarter. This means you only spend money on absolute necessities like bills and groceries. This exercise resets your spending habits and forces you to find free entertainment options, like visiting a park, reading a library book, or having a game night at home. It is a great way to break the cycle of mindless spending and appreciate the things you already have. Tracking your spending, or lack thereof, during the challenge can highlight just how much discretionary spending adds up.

11. Move Your Savings to a High-Yield Account

If your emergency fund or general savings is sitting in an account with one of the big national banks, you are likely losing money to inflation. A traditional savings account often pays a tiny fraction of a percent in interest, which is practically zero. You can make your savings work for you by moving it to a high-yield savings account (HYSA).

These accounts, typically offered by online banks, can offer interest rates that are significantly higher than traditional accounts. While rates fluctuate, the difference is always substantial. This means your money is actively growing on its own, generating more money without you having to do anything. This is the definition of passive income. Making this one-time switch can earn you hundreds of dollars a year in extra interest, depending on your balance. It is a simple, powerful way to ensure your savings are keeping pace and generating their own “free money.”

12. Pack Your Lunch

The daily habit of buying lunch can be a silent budget killer. A $15 lunch five days a week adds up to $300 a month. Packing your lunch, even just a few times a week, can free up a substantial amount of cash. Plan your lunches when you plan your weekly dinners. Often, you can make a little extra at dinner to have as leftovers for the next day. This is a simple lifestyle tweak with a huge financial impact.

13. Use the Library

Your local library is a treasure trove of free resources. Beyond books, most libraries offer free access to movies, music, audiobooks, and even museum passes. Many also provide free access to online learning platforms and digital magazines. Before you buy a book or rent a movie, check if you can get it for free from your library. It is an amazing community resource that is often underutilized.

14. Shop Your Pantry for a Week

This can be a fun challenge that can instantly free up a significant chunk of your budget. For one week, commit to not buying any groceries. Instead, create all of your meals using only the food you already have in your pantry, freezer, and refrigerator. It forces you to get creative with that can of beans, the frozen vegetables, and the various pastas you have stored away.

Start by taking a full inventory of what you have on hand, then search for recipes that use those ingredients. You will likely be surprised by the variety of meals you can create. The benefit is immediate and tangible. By completely skipping a week of grocery shopping, you have “found” that money in your budget. If you typically spend $150 a week on groceries, that is $150 you can now allocate to a savings goal or paying down debt. Doing this once a quarter is a fantastic way to reset your food spending and reduce waste.

15. The “Round Up” Method

This is a painless way to save. Every time you make a purchase with your debit card, round the amount up to the nearest dollar and transfer the difference to your savings account. Some banking apps will even do this for you automatically. That $3.50 coffee becomes a $4 transaction, with 50 cents going directly to savings. It feels small in the moment, but it accumulates surprisingly fast. Having a spreadsheet where you can see all your transactions makes it easy to do this manually if you choose.

In your Tiller Foundations spreadsheet, add a column for “Round Up” with the formula:

=CEILING(A2, 1) – A2Add up the rounding amounts and add them to your savings account.

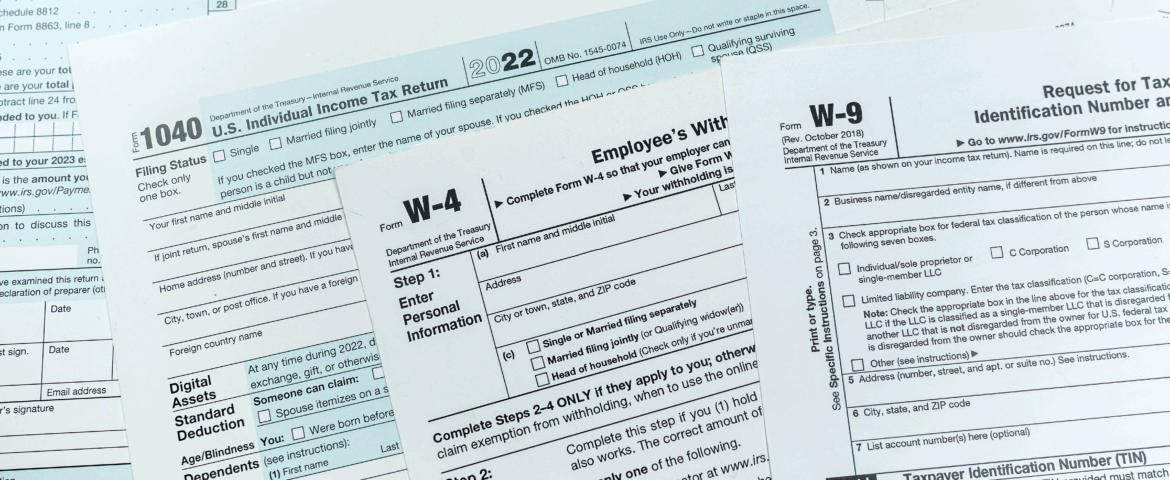

16. Adjust Your Tax Withholding

For many people, getting a large tax refund feels like a celebratory windfall. However, what it actually means is that you have been giving the government an interest-free loan with your own money all year long. You overpaid on your taxes with each paycheck, and the government is simply returning what was already yours.

You can claim that money throughout the year by adjusting your tax withholding. By changing your W-4 form with your employer, you can aim for a much smaller refund, or none at all, and instead receive more money in each paycheck. The IRS has a free Tax Withholding Estimator tool on their website to help you do this accurately. Unlocking an extra $100 or more in each paycheck can make a significant difference in your monthly budget, freeing up cash flow for saving, investing, or paying down debt. It’s a powerful way to put your money back to work for you immediately.

17. Stop Paying Unnecessary Bank Fees

Monthly maintenance or service fees on a checking account are a common budget leak that many people accept as a fact of life. However, you should not have to pay a fee simply to have a bank hold your own money. These small charges of $10 or $15 a month add up, siphoning over a hundred dollars a year from your budget for no real reason. Review your bank statements and if you see a recurring monthly fee, take action. Most banks will waive this fee if you meet certain requirements, such as setting up a direct deposit or maintaining a minimum daily balance. A quick call to customer service or a visit to your bank’s website can tell you how to get the fee removed. If your bank’s requirements don’t work for you, consider switching to a credit union or online bank, which often offer checking accounts with no fees and no strings attached.

18. Automate Your Bill Payments

Late fees are the definition of throwing money away. A single missed payment can cost you $30 or more, not to mention the potential negative impact on your credit score. Set up automatic payments for all of your recurring bills to ensure they are always paid on time. Having a clear view of your account balances in one place can give you the confidence that you will have enough funds to cover your automatic payments.

19. Embrace a “Buy It For Life” Mentality

For items you use frequently, it can be more cost effective to invest in a high quality, durable product that will last for years, rather than repeatedly buying cheap versions that need to be replaced. This applies to things like kitchen knives, winter coats, and work shoes. The upfront cost is higher, but you will save money in the long run. This approach encourages you to be more thoughtful about your purchases and to value quality over quantity.

20. Stop Paying for Perks You Already Get for Free

You could be paying for services that are already included for free as a benefit of another product you own. Finding and eliminating these redundant expenses is a fantastic way to free up money. For example, some premium credit cards offer complimentary cell phone insurance if you pay your phone bill with that card, allowing you to cancel the expensive insurance plan from your carrier. Similarly, some cell phone plans bundle in streaming service subscriptions like Netflix™ or Max™. If you are paying for that streaming service separately, you are throwing money away. Take an hour to review the full list of benefits for your credit cards and your cell phone plan. Canceling a single overlapping service can easily put $15 or more back into your budget each month.

21. Plan for Irregular Expenses

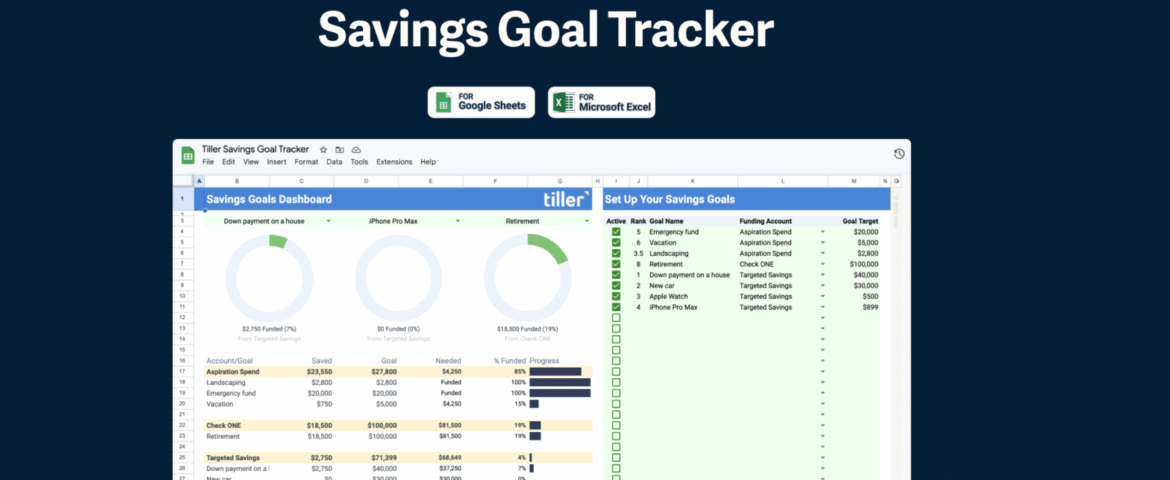

Expenses like holiday gifts, annual subscriptions, and car maintenance don’t happen every month, but they are not surprises. Create sinking funds for these irregular but predictable expenses. This means setting aside a small amount of money each month into a specific savings category. When the expense comes due, the money is already there, and you won’t have to scramble or go into debt. The Tiller “Savings Goal Tracker” allows you to set specific goals and decide which accounts are funding those goals.

22. Leverage Your Employee Benefits

Your salary is only one part of your compensation. Take the time to fully understand and utilize your employee benefits. This could include a 401(k) match, a health savings account (HSA), or discounts on products and services. A 401(k) match is literally free money; not taking full advantage of it is like turning down a raise. Review your benefits package to make sure you are not leaving any money on the table.

23. Pay for Health Costs with Pre-Tax Money

If your employer offers a Flexible Spending Account (FSA) or Health Savings Account (HSA), you have access to a powerful tool for saving money. These accounts allow you to set aside a portion of your income before taxes to pay for eligible medical expenses. This includes everything from doctor visit co-pays and prescriptions to dental work, eyeglasses, and even everyday items like sunscreen and bandages. When you use these pre-tax dollars for these necessary purchases, you are effectively getting a discount equal to your tax rate. For example, spending $100 from your FSA can feel like spending only $75 or $80 of your take-home pay. This is a strategic way to reduce the cost of a major budget category, freeing up money that would have otherwise gone to taxes.

24. Review Your Credit Report for Errors

An error on your credit report can directly cost you money by leading to higher interest rates on everything from car loans to mortgages. These mistakes are more common than you might think and can range from incorrect payment statuses to fraudulent accounts opened in your name. By law, you are entitled to a free credit report every year from each of the three main credit bureaus. Go to the official government mandated website, AnnualCreditReport.com, to get your free reports. If you find an error, dispute it immediately with the credit bureau. Correcting a mistake can improve your credit score and ensure you qualify for the best interest rates, saving you thousands of dollars and keeping that money in your budget.

25. Track Your Progress and Celebrate Wins

Finding free money in your budget is a journey, not a destination. It is crucial to track your progress. When you can see your savings grow or your debt shrink, it provides the motivation you need to keep going. Tiller gives you a clear, up to date view of your entire financial picture. Tiller allows you to see the real impact of your efforts.

Tiller Helps You Find the “Free Money” in Your Budget

The journey to finding “free money” in your budget begins with a single, foundational step: truly knowing your spending categories. Tiller is the tool designed to provide this exact financial clarity. We build tools that make it easy to understand your money, your way. Tiller does this by automatically tracking your daily spending, income, and account balances and bringing your financial life into a spreadsheet, automatically updated each day. With ultra-customizable automatic transaction categorization, you can create a budget that perfectly mirrors your life. This is the clarity that allows you to stop guessing and start seeing exactly where to find the “free money” hidden in your budget. When you are in better control of your money, you can align it with your values and profoundly improve your life.