Starting your financial journey as a young adult can feel overwhelming. You’re building a career, managing expenses, and figuring out how to save for the future. With so much to think about, it’s easy to feel like you’re missing a manual.

But the truth is, you don’t need to do everything perfectly from day one. What matters is taking the next right step. These five high-impact financial tips will help you build clarity and confidence with your money so you can move from uncertainty to control.

1. Master Your Budget

Budgeting often feels like a restriction, but it’s actually a tool for empowerment. A well-structured budget gives you visibility and control. It ensures your money is working toward what matters most to you. Whether that’s covering your essentials or saving for travel, a home, or a business idea.

How to Create Your First Budget

Step 1: Calculate your income.

Start with your take-home pay (after taxes). Include income from side hustles or freelance work. This is the total amount you have to work with each month.

Step 2: Track your spending.

Spend a full month logging every transaction: groceries, streaming services, rideshares, coffee, and more. This creates an honest picture of your spending habits.

Step 3: Analyze and make a plan.

At the end of the month, categorize your spending. Compare it against your income. Are you spending in ways that reflect your priorities? Use this data to decide what to adjust going forward.

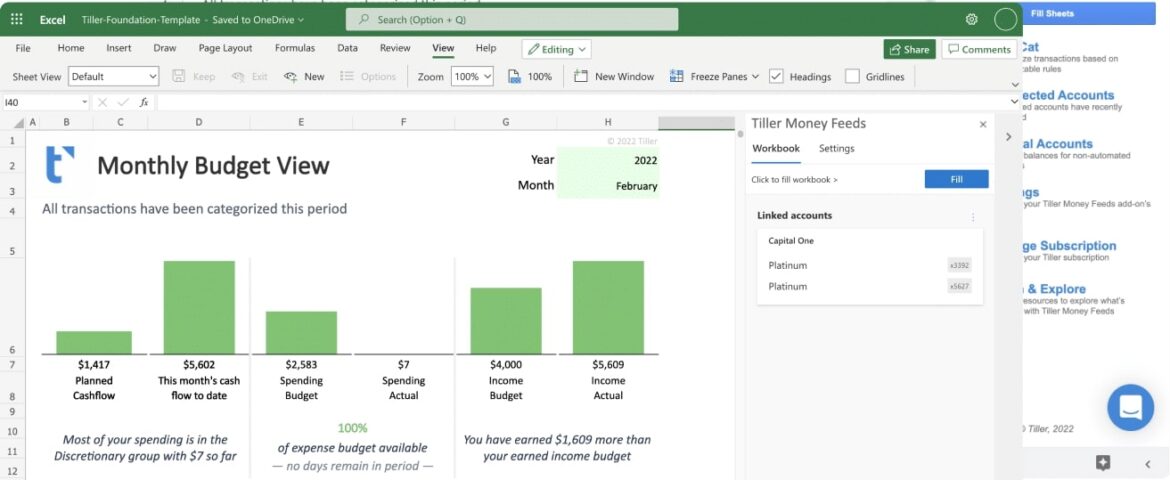

Why a Spreadsheet Budget Works

Spreadsheets are flexible. Your life will change, your budget should be able to change with it. Whether you’re managing multiple income streams, saving for a move, or tracking family expenses, a spreadsheet gives you total control and visibility.

Tiller simplifies this process by automatically importing your daily transactions and balances from over 21,000 financial institutions into Google Sheets or Microsoft Excel. This eliminates the need for manual data entry and allows you to focus on what matters: making informed decisions with your money.

2. Tackle Debt Strategically

Debt, especially high-interest debt, can silently erode your financial progress. Creating a strategy to eliminate it allows you to reclaim your income and put your money to better use.

Understand Your Debt

Make a list of every account you owe on. Include:

- The lender name

- Outstanding balance

- Minimum monthly payment

- Interest rate (APR)

This gives you a full picture of what you’re up against.

Choose a Repayment Strategy

Avalanche method:

Focus on the debt with the highest interest rate first while making minimum payments on the rest. This saves the most money over time.

Snowball method:

Pay off the smallest balance first. This builds quick momentum and motivation as you check off paid accounts.

Choose the approach that will keep you engaged, and stick with it.

Stay Out of New Debt

As you pay down your current debt, avoid taking on new balances. Use your budget to anticipate large expenses and set up a “sinking fund.” A separate savings category for future costs like car repairs or travel.

Spreadsheets make it easy to create these savings categories and watch your progress.

3. Build Your Financial Foundation

Once you have a working budget and a debt plan, it’s time to build a safety net and begin investing in your future.

Start with an Emergency Fund

Life is unpredictable. A basic emergency fund protects you from relying on credit cards when the unexpected happens.

Start with a goal of saving $1,000. Then build toward three to six months of essential living expenses. Keep this money in a separate high-yield savings account where it is accessible but not tempting to use for daily spending.

Use your spreadsheet to set this target, track your progress, and stay consistent.

Start Investing Early

The earlier you begin investing, the more you benefit from compound growth.

Start by contributing to your workplace 401(k) if you have one, especially if your employer offers a match. This is free money.

Then consider opening a Roth IRA. You contribute after-tax income, and your investments grow and can be withdrawn tax-free in retirement.

You do not need to pick individual stocks to get started. Low-cost index funds and ETFs offer built-in diversification.

A spreadsheet helps you track your contributions and balances across different accounts, giving you a clear view of your financial future.

4. Set and Automate Financial Goals

Your financial goals give your money direction. Without clear targets, it’s easy to lose focus or fall into reactive spending.

Define Your Goals

Categorize your goals by time frame:

- Short-term (1–3 years): Emergency fund, moving costs, travel

- Mid-term (3–10 years): Car, wedding, home down payment

- Long-term (10+ years): Retirement, financial independence

Be specific. “Save for a home” becomes more actionable when stated as, “Save $30,000 for a down payment by age 30.”

Automate Savings

The best way to reach a financial goal is to remove willpower from the equation. Schedule automatic transfers into savings accounts the day after payday. This ensures the money is saved before you have a chance to spend it.

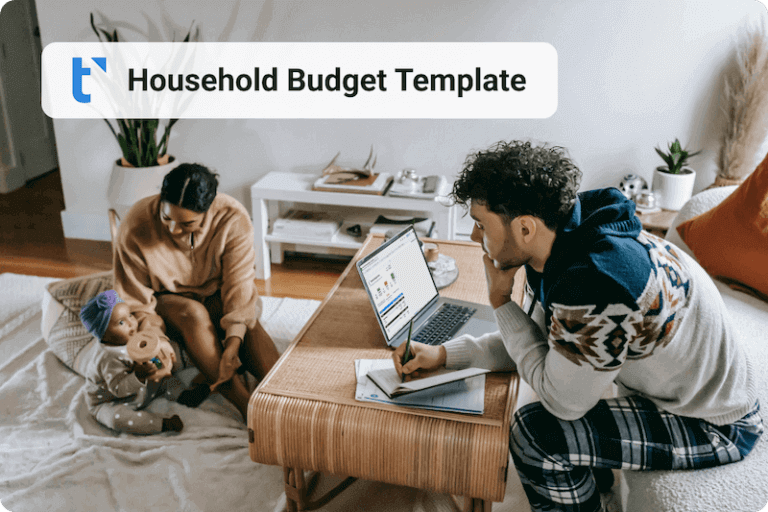

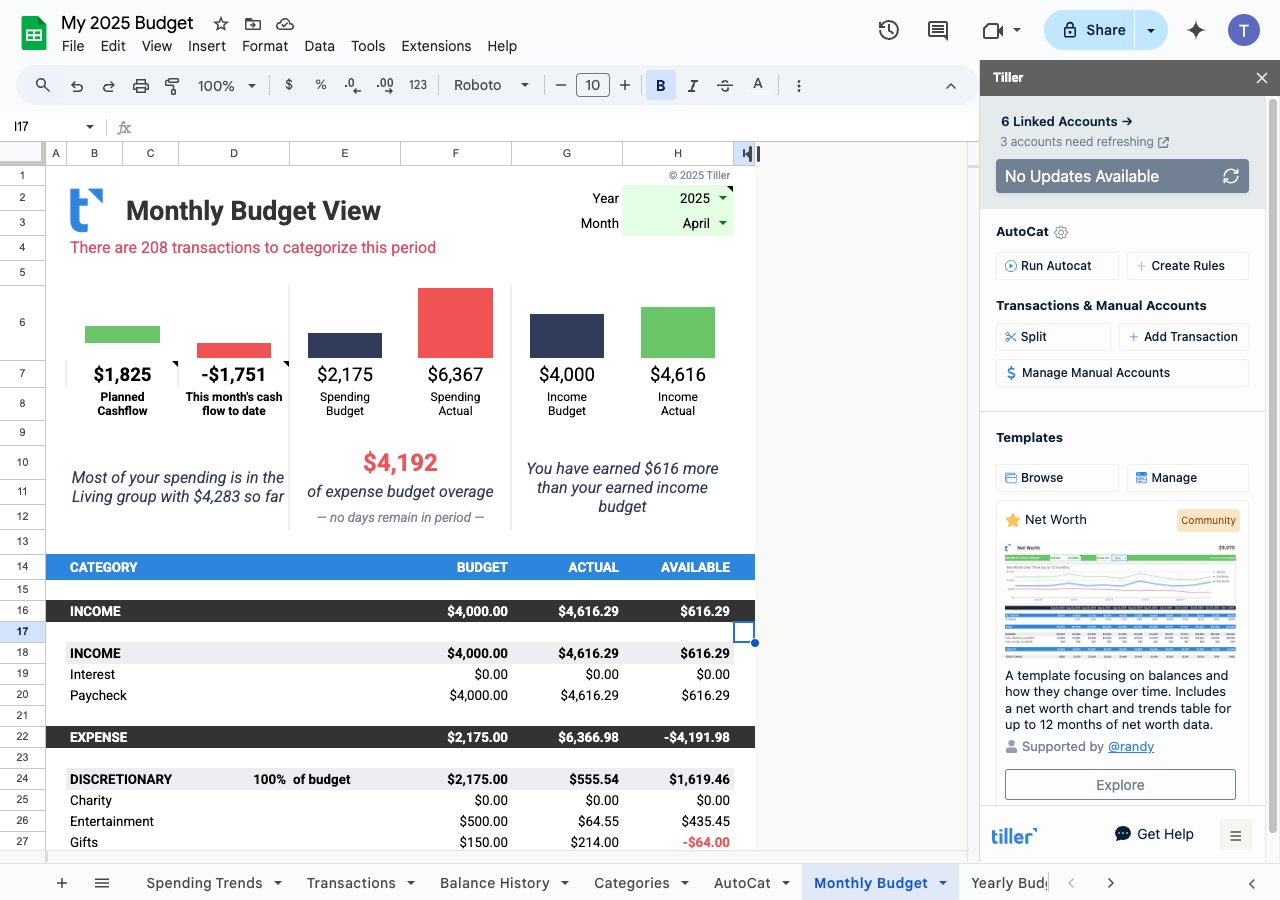

Tiller-powered spreadsheets make it easy to track automated savings over time. You can customize dashboards for each goal and monitor how your efforts are paying off.

Seeing a category like “Vacation to Hawaii” grow each month reinforces motivation and builds positive momentum.

5. Build Financial Knowledge

Understanding personal finance puts you in control. It empowers you to ask the right questions and make confident decisions.

Make Learning a Habit

You do not need a finance degree to manage your money well. Learn the basics through blogs, books, and podcasts. Follow credible voices that teach practical strategies and promote financial wellness.

The Tiller blog offers in-depth articles and tutorials to help you use spreadsheets to manage your money with clarity and purpose.

Leverage Community and Templates

The Tiller Community offers shared templates and workflows developed by other users. You do not have to build everything from scratch. There are solutions to help you save time and improve your systems.

As you build knowledge, your financial anxiety will shrink. You will move from reacting to your finances to confidently directing them.

Start Building Your System Today

Financial clarity is not about doing everything perfectly. It is about taking small, intentional steps and repeating them over time.

When you build a budget that reflects your values, automate your goals, and learn how to adjust as life changes, you begin to create a financial life that works for you.

Tiller makes it easier to stay engaged by handling the most tedious part of budgeting: transaction data entry. With all your financial information organized in one spreadsheet, you have the clarity and tools to take action.

Start your free 30-day trial of Tiller today.

No credit card charged until the end of your trial. Cancel anytime.

Because when your money is clear, your next steps are, too.