Managing debt can be an emotionally and financially draining experience. High interest rates make it harder to make progress, and juggling multiple accounts can feel confusing and discouraging. But with the right strategy and the right tools, you can make steady, measurable progress. The avalanche method is one of the most effective approaches to paying down debt, and when used with Tiller’s automated spreadsheets, it becomes even more powerful.

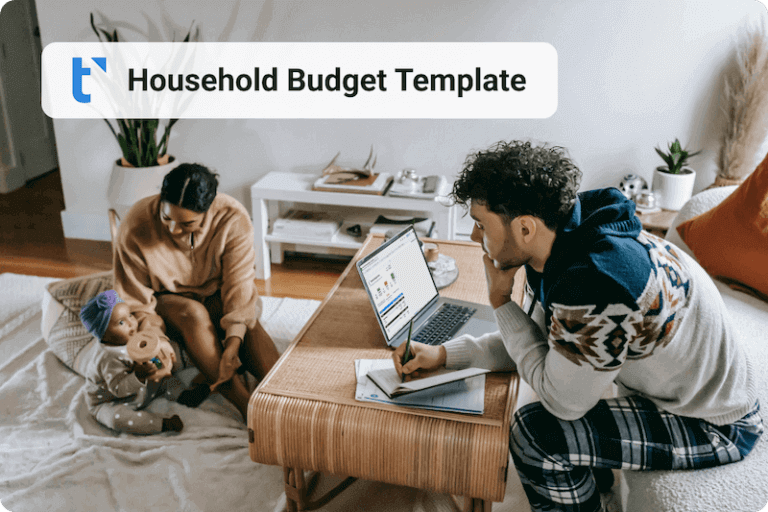

Tiller makes it easy to manage your finances in a spreadsheet by automatically pulling in your latest transactions, balances, and account information every day. This real-time visibility is the perfect foundation for building a clear, strategic debt payoff plan.

What Is the Avalanche Method?

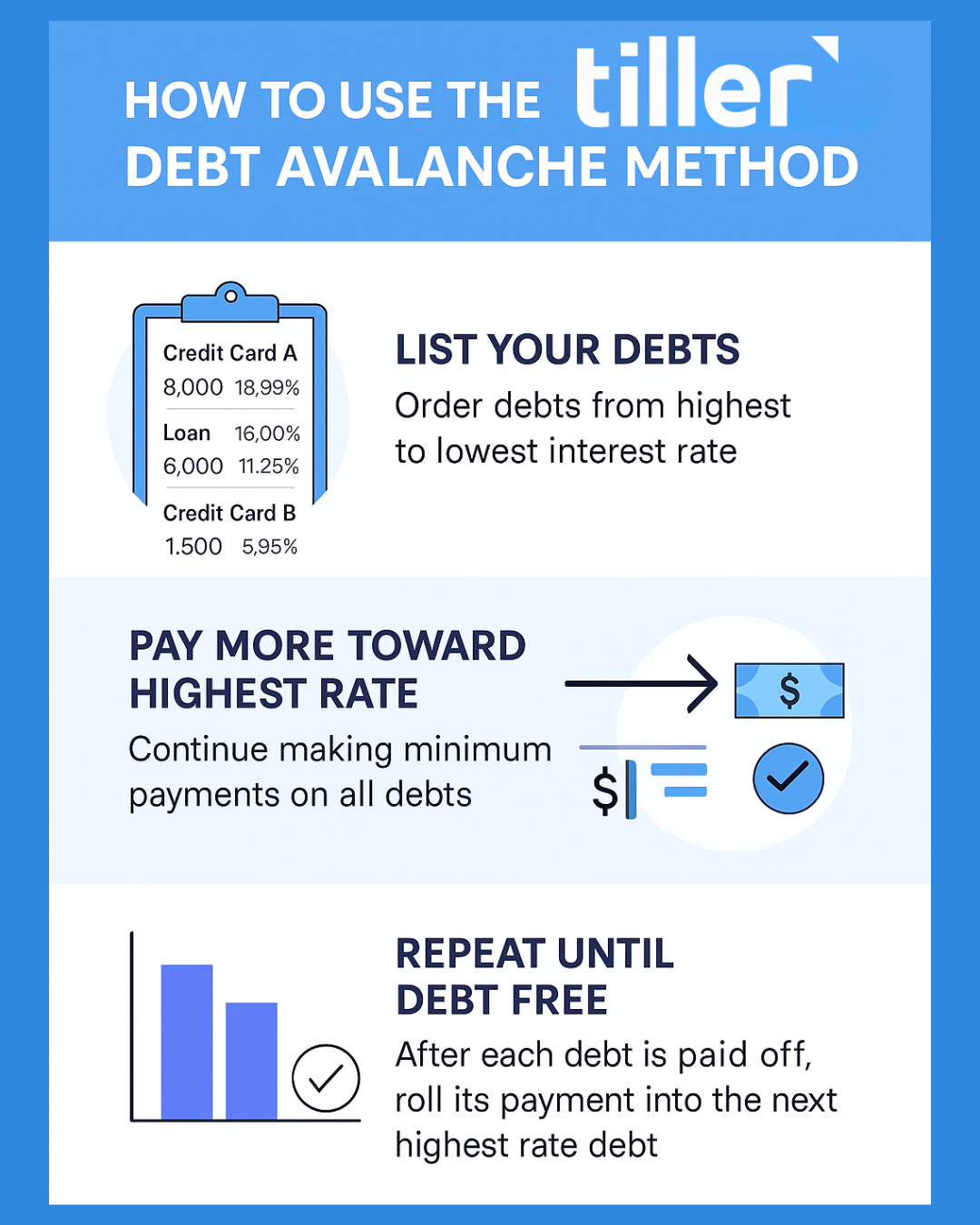

The avalanche method is a systematic debt repayment strategy designed to minimize the total interest you pay over time. It works by prioritizing debts based on their interest rates, rather than their balances. With this approach, you focus your extra payments on the debt with the highest annual percentage rate (APR), while continuing to make the minimum payments on all other accounts.

As you pay off each debt, you roll the amount you were paying on it into your next-highest interest debt. This creates a compounding effect, similar to a snowball, but optimized for saving money rather than emotional wins. While the debt snowball method focuses on paying off the smallest balance first, the avalanche method focuses on reducing the financial cost of debt more quickly.

This method is particularly well-suited for people who value efficiency and long-term savings. If you are comfortable with a slower start in exchange for saving more money overall, the avalanche method will serve you well.

Why Tiller Is the Ideal Tool for the Avalanche Method

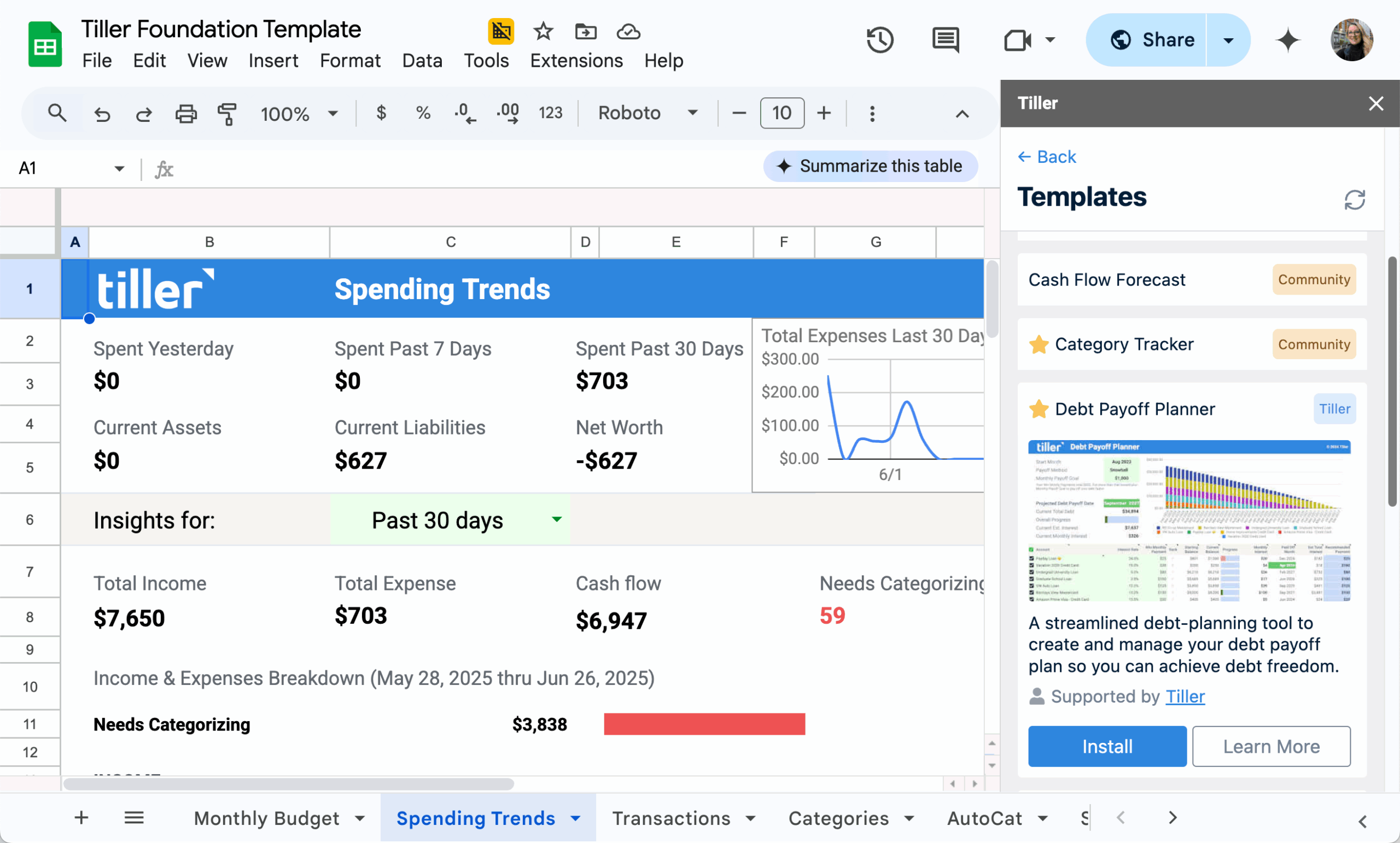

Tiller is the only personal finance service that combines the flexibility of a spreadsheet with the convenience of automated financial data feeds. It works with both Google Sheets and Microsoft Excel, giving you the ability to track every detail of your debt repayment plan while saving time on manual data entry.

Each day, Tiller pulls in your updated transactions and balances from over 21,000 financial institutions. This means you always have the most current view of your debts, spending, and available income. You can customize your spreadsheets as much as you need. Whether you want to create simple trackers or complex dashboards.

Tiller also provides a library of free community-built templates, including debt payoff calculators and budgeting tools. These templates can be used as-is or customized to suit your preferences.

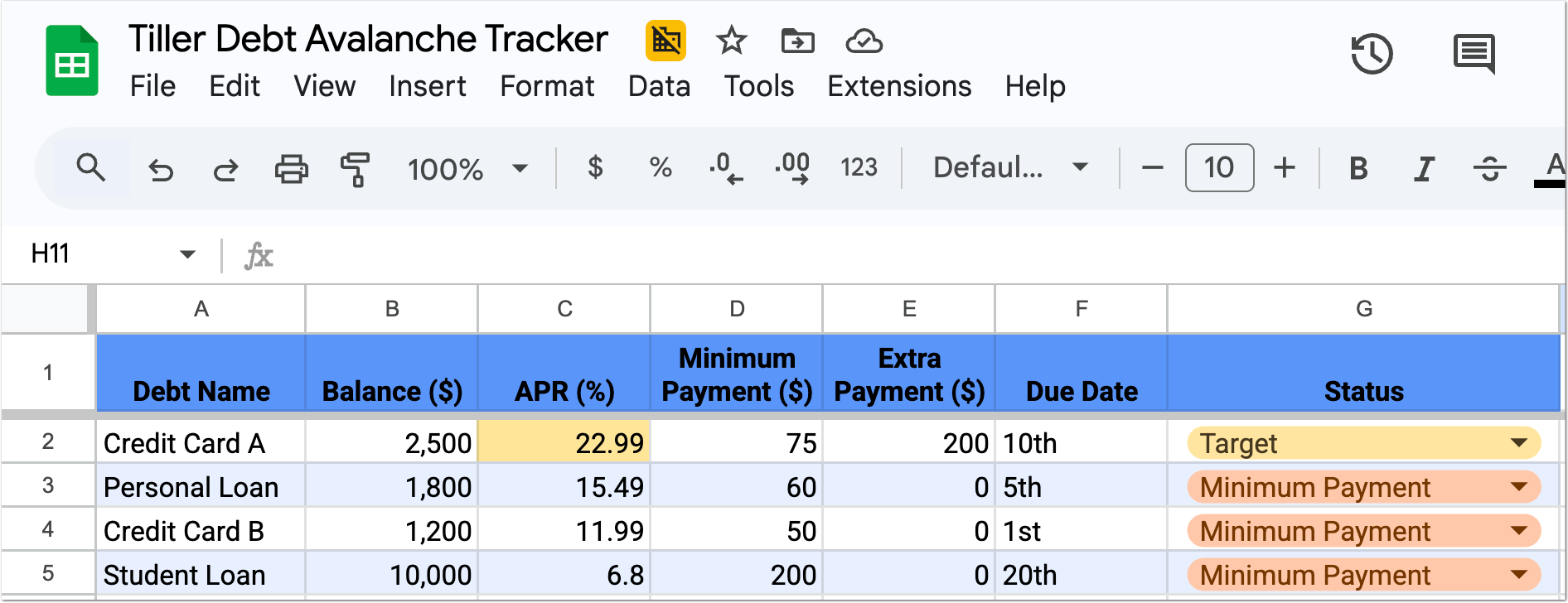

Tiller offers a powerful Debt Payoff Planner template. This template allows you to choose your preferred payoff strategy, including the debt avalanche method. It automatically calculates your payoff timeline and the total interest you will pay based on your debts and your planned monthly payments. You can experiment with different scenarios to see how increasing your payments can accelerate your debt freedom date.

Step-by-Step: Using the Avalanche Method in Tiller

1. Set Up Your Tiller Account

First, sign up for Tiller and link your financial accounts. This should include all credit cards, personal loans, student loans, and other debts. For loans from family members, you can create a manual account. Tiller will then automatically sync your latest balances and transactions to your spreadsheet.

2. Gather and Organize Your Debt Information

Start by listing out each of your debts in your Tiller spreadsheet, on a new sheet. Include the following information for each account:

- Name of the account or creditor

- Current balance

- Annual interest rate (APR)

- Minimum monthly payment

- Payment due date

Sort the list by interest rate in descending order. This ordering will determine the sequence in which you’ll pay off the debts.

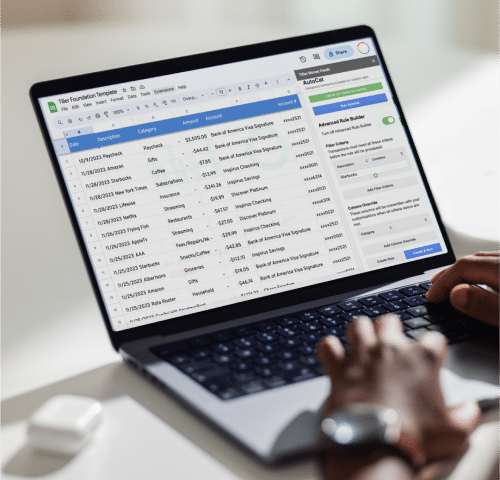

2. Track Debt Payments with Categories

Use Tiller’s AutoCat feature to categorize your debt payments automatically. Create clear, distinct categories for each debt, such as “Credit Card A Payment” or “Student Loan Payment.” This makes it easy to track how much you are paying toward each account in your monthly and annual spending summaries.

You can also use tags or notes in your transaction data to flag which payments are part of your avalanche plan.

3. Build a Customized Budget to Find Extra Funds

Review your monthly spending in the Foundation Template or a customized budgeting sheet. Identify discretionary categories where you can reduce expenses, such as takeout meals, streaming subscriptions, or unplanned shopping. The money you save can then be directed to your highest-interest debt.

Even modest adjustments, like cutting an unused/rarely used subscription, can accelerate your progress. Once you know how much extra you can apply each month, you can add this amount to your payment on the top-priority debt.

4. Use Charts or Progress Trackers for Motivation

Staying motivated is key to following through with any long-term financial plan. Create a visual progress tracker that shows how your balances are decreasing over time. Tiller’s community offers templates for debt snowball and avalanche strategies that include built-in charts, or you can build your own.

Consider tracking your overall debt, monthly progress, interest saved, and time remaining to debt freedom. These visual cues help you stay encouraged, even during slow months.

5. Schedule a Monthly Financial Review

Set aside time each month to review your progress and update your plan. In your Tiller spreadsheet, review the balances, update your tracker, and confirm that your payments were applied correctly.

Ask yourself:

- Am I still putting the maximum extra funds toward the highest-interest debt?

- Have any of my interest rates changed?

- Are there any new debts I need to include?

Keeping your plan up to date ensures that you stay focused and make the most of every dollar you put toward your debt.

6. Make Adjustments as Needed

Life happens. If you receive a bonus, unexpected bill, or change in income, use Tiller to quickly revise your strategy. Because your spreadsheet is flexible and always up to date, you can test out scenarios before making changes.

You can also add new features to your spreadsheet over time, such as formulas to calculate total interest saved, or conditional formatting to highlight accounts nearing zero.

Who Benefits Most from the Avalanche Method?

The avalanche method is well-suited for people who want to save as much money as possible over the life of their debt. It works best for those who are financially disciplined and do not need the quick psychological wins offered by the snowball method.

That said, many people find success using a hybrid approach—starting with the avalanche method, but occasionally prioritizing a small balance for emotional motivation. Tiller makes it easy to adjust your strategy to fit your preferences, goals, and real-world circumstances.

Final Thoughts: Pairing Strategy with Automation

Getting out of debt requires more than good intentions. It takes a clear plan, accurate data, and the ability to adapt. The avalanche method provides the strategy, and Tiller provides the structure.

With Tiller, you can track all your debt payments, monitor your budget, and adjust your goals without starting from scratch or relying on a generic app. You have complete control over your data, and you can customize every detail of your spreadsheet to meet your needs.

Start today by creating a Tiller spreadsheet that lists your debts in order of interest rate. Set up categories for each account, identify extra funds in your budget, and begin applying them toward your top-priority debt. Use your monthly reviews to stay on track, and let the combination of strategy and automation guide you toward financial freedom.

Tiller makes debt payoff clear, flexible, and achievable—especially when paired with a proven method like the avalanche.