The resolve to master your finances often arrives with a quiet intensity. You decide that this year will be different. You are done with the vague unease that follows every swipe of your card and you want to build a life of intention where your money serves your goals. You are ready to stop reacting to expenses and start commanding them. This moment invites you to step back from the stress and reconnect with what actually matters to you.

Free: The Financial Reset e-Book

The High Cost of Financial Guesswork

Many of us spend years reacting to bills and surprises without ever defining the experience we hope to create. We rely on mental estimates of our salary versus our bills which often leads to errors. We think we spend a certain amount on groceries or dining out yet the data often tells a different story. This gap between feeling and fact is not a failure but simply where clarity begins.

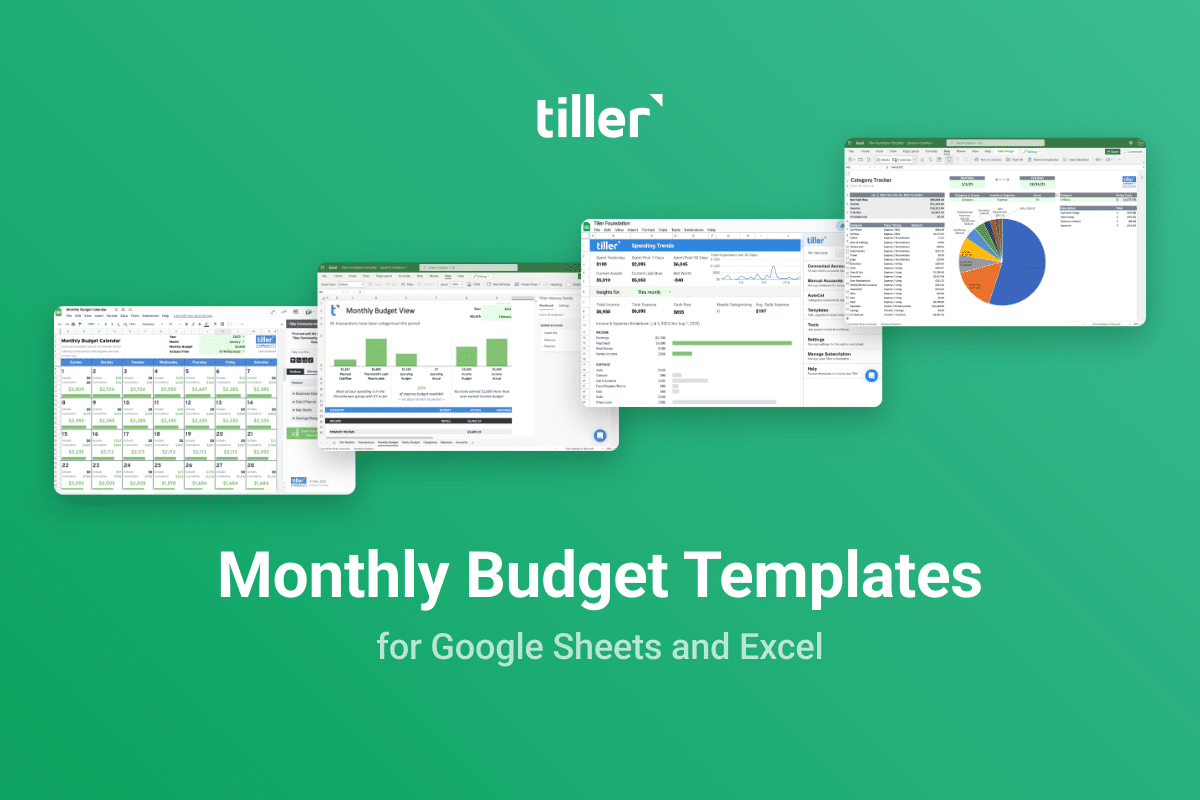

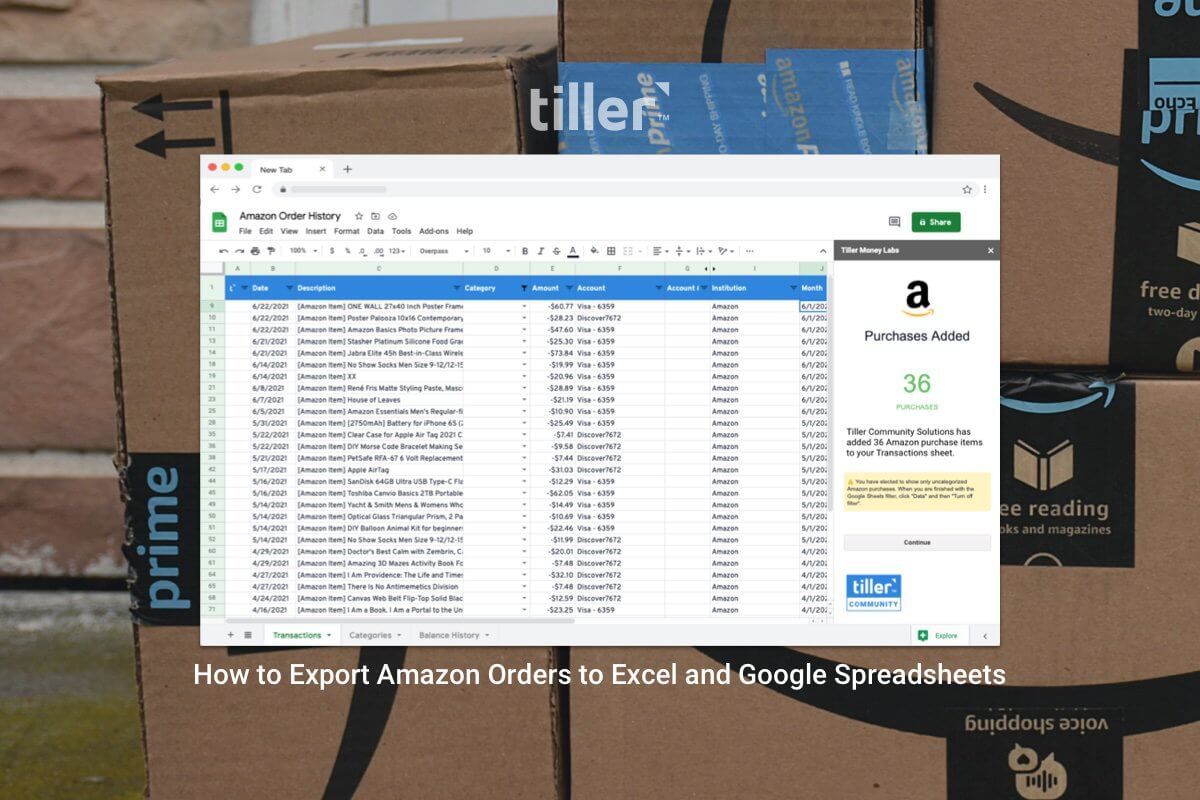

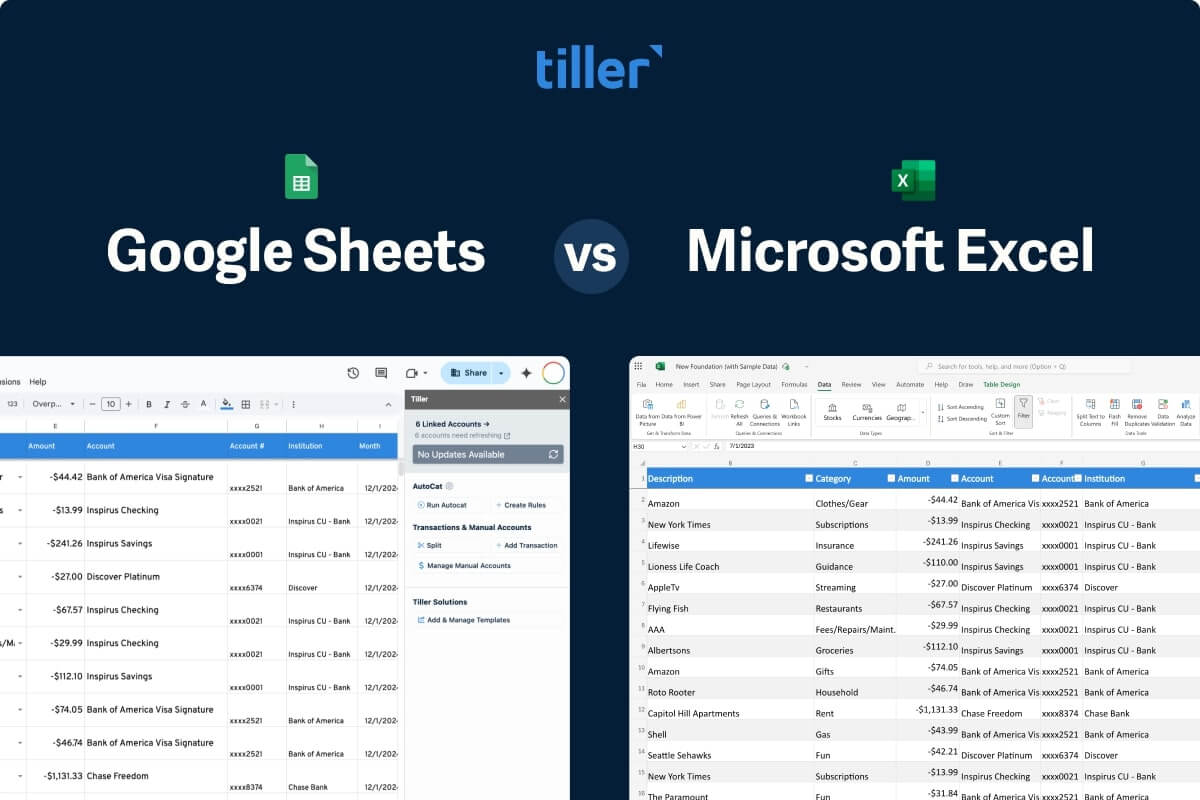

When you lack a clear system you often end up acting as a data entry clerk for your own life. You log into your bank account and open a second tab for your savings and a third for your investments. You copy numbers from one screen and paste them into another. By the time you finish the administrative work you have no energy left to act as the strategist of your own life. You close your computer with a spreadsheet that is already out of date. You did the work but you still lack the clarity.

This cycle of manual tracking and vague guessing creates anxiety. We ignore bills because we are afraid of what they might say. We leave envelopes unopened and hope for the best because we think that is just how money works. But avoiding the reality of your finances does not make the stress go away. It just keeps you in a state of reaction rather than abundance.

Why Awareness Matters More Than Judgment

A financial reset is not about punishing yourself for past mistakes. Understanding your money begins with awareness rather than judgment. It requires a system that respects your reality rather than trying to fit your messy life into perfect little boxes. Rigid apps often break when life gets complicated but a flexible system adapts to you.

Clarity is empowering. When you see your financial life clearly you create the conditions for meaningful change and build a steadier foundation for your future. A view of year-to-date numbers smooths out irregular months and gives a factual baseline for life. This awareness replaces vague worry with understanding and reduces the stress of guessing.

Reset Your Finances For What Truly Matters

We often believe that financial success requires a magic formula or a massive salary but the truth is simpler. It requires a personalized system that adapts to your life. Money matters because life matters more. When you control your money you show up differently for the people and experiences that count. You become calmer and clearer and more present for the moments that truly define your wealth.

The 2026 Financial Reset guide breaks this journey down into manageable steps. It provides a roadmap to help you build a system that sustains you. From establishing your baseline to planning for the unexpected and taking command of debt the guide supports you every step of the way.

We invite you to download the guide and start your journey today. Use it to build a life of intention. Use it to stop guessing and start knowing.

At Tiller we always respect your privacy. We never sell your data or show you advertisements. The 2026 Financial Reset Guide is free without obligation. You’ll receive a copy of the guide to download as well as be added to our Hello, Money newsletter for additional tips on aligning your values and your money.