“Mom, we’re rich!” 12-year-old Chris said as he stared at the number on his mother’s paycheck.

Educator and mom Hedreich Nichols had just done something most parents avoid: showed her entire finances to her son.

Five minutes later, after going through the mortgage, food, and gas bills, he looked up and asked, “We pay THAT much?”

He understood: managing money takes planning and prioritization.

That five-minute budget conversation changed how Chris thought about money.

Hedreich used radical transparency to raise a financially independent son. As a teacher, Hedreich loves to show other parents how they can teach their own children strong financial habits.

The best part is that you don’t need a finance degree or a perfect budget to start. You just need to invite your child into the conversation.

Here’s how to start.

Money Lessons Passed Down Through Generations

Hedreich learned this approach to money from her own mother. At age 12, she asked her mom to buy something and got an unexpected response: “Here’s the checkbook.”

“This is how much I make,” her mom told her. “Here are our expenses. Here’s my budget. If you can find the money for it, you can buy it.”

Sitting at the kitchen table, Hedreich worked through the budget and had to tell herself no. “All of a sudden I understood there were a whole lot of decisions and factors influencing that yes or no,” she recalls.

It wasn’t arbitrary or “mom being mean.” It was math.

Years later, she did the same thing with Chris. She showed him everything: her salary, their monthly expenses, their budget. Together they paid bills online, set up automatic payments, and tracked expenses.

The payoff was quick. By age 14, Chris was earning his own money by playing bass professionally. He learned how to spend his own money, not just his mom’s. And he was able to buy more extravagant gifts than what a normal 14-year-old might.

When his dad started giving him an allowance, he invested it rather than spending it.

By his senior year, when it was time to shop for school clothes, he told her: “Mom, I really don’t need anything. I make my own money. I’m good.”

By 21, he was financially independent, married, and serving in the military.

Three Everyday Practices That Built Chris’s Financial Competence

One of Hedreich’s favorite teaching methods is weaving financial lessons into everyday decisions.

1. The “No Cash Register” Rule

If Chris wanted gum, they didn’t grab it impulsively at checkout. Instead, they would head back to the aisle to get a larger package that provided more value for the money. This one rule taught the difference between reacting and choosing.

2. Planned Spending

Tuesdays meant bass lessons and Blaze Pizza. Sundays meant dinner out. These were not random treats—they were budgeted traditions Chris could anticipate and understand.

3. Work Backward From Goals

When Chris wanted something expensive, he calculated: How much? How long to save? What could he earn? Abstract desires became concrete math problems with real solutions.

How to Start (Even If You’re Still Figuring Out Money Yourself)

Don’t worry if you’re not confident about your own money management. Hedreich encourages parents to start small, even with just one category.

1. The Food Budget

Everyone has one. Let kids track spending, compare unit prices, and make shopping decisions. Connect it to their goals: “Want that Chuck E. Cheese party? Let’s save $100 a month on groceries for three months. You plan the menus.”

2. Trip Planning

Weekend getaways always run over budget. Put kids in charge of planning routes, stops, and rest-stop budgets. Hedreich laughs: “Get me at a rest stop and all caution goes to the wind. Look, soap!” Planning ahead prevents these budget leaks.

3. The Credit-Building Hack

Add your child as an authorized user on your credit card. Keep it in a drawer and never use it. By the time they leave home, they’ll have years of credit history and a massive head start on apartment applications and car loans.

Don’t Rely on School to Teach Your Kids About Money

These lessons work beyond individual families. As an educator, Hedreich sees the gap clearly: “We teach algebra, geometry, calculus. But students leave without knowing what to do with their first credit card application.”

So in her middle-school tech class, she had students price out their Christmas wish lists, including $800 sneakers. Then she challenged them to create a savings plan to show how their parents could make it happen.

Suddenly, kids who struggled with abstract math were calculating payment plans and proposing businesses (lawn cutting, website building). The math made sense because the motivation was real.

As a parent, you can use similar lessons to teach your children at home.

The Multi-Generational Ripple Effect

Hedreich’s mother taught her. She taught Chris. And someday Chris will likely sit down with his children and ask, “Can we afford it?”

This is how financial futures change—not through dramatic interventions, but through honest conversations that replace secrecy with understanding.

You don’t need expertise or perfect finances. You just need the willingness to pull back the curtain.

Start with one category, one conversation, one month of bills, or one trip budget.

The question isn’t whether your kids are ready to learn about money.

The real question is: what money conversation will you have this week?

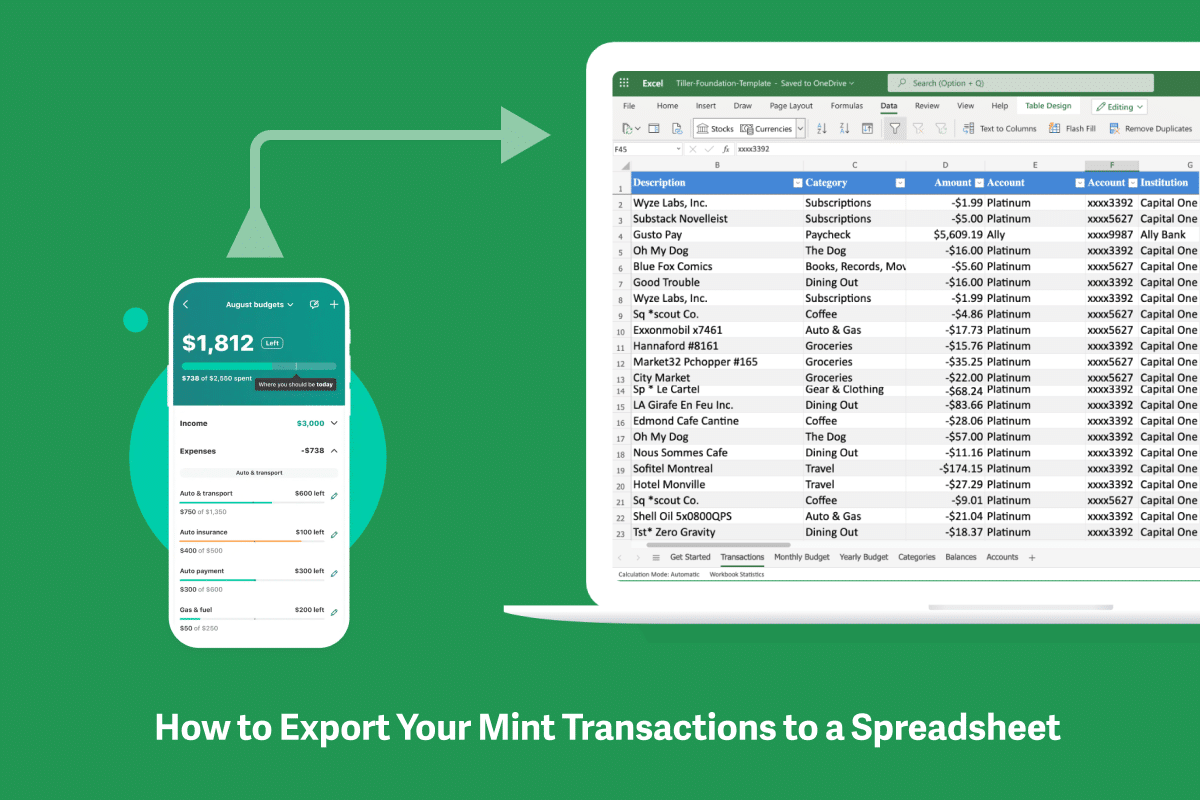

Ready to try this with your kids? Tiller offers free subscriptions for students and helps families track spending, categorize expenses, and understand where money goes—all in spreadsheets that students already know how to use. Get started here.