Guiding adult children through the complexities of personal finance presents a unique challenge for many parents. You want to empower them, yet you also know when a nudge or a new perspective might help. We recently sat down with Tiller’s own CFO, Audrey Hicks, who is not only a seasoned financial expert but also a mother to two adult children. In a candid conversation with Tiller’s founder, Peter, Audrey shared her practical advice and hard-earned wisdom.

A Conversation With Founder Peter Polson & CFO Audrey Hicks

Understanding Their Financial Nature

Audrey believes that when it comes to money habits, nature often plays a significant role. “I really think it’s more nature,” she shared, reflecting on her own two children. Despite a consistent upbringing in financial education, her daughter emerged as a natural saver, while her son tended to spend more freely.

From a young age, Audrey implemented classic financial literacy strategies. Her children received allowances with a clear structure: a portion for immediate spending, some for later goals, and a part for giving away. As they grew, around age ten, they graduated to full budgets. These budgets came with agreements on what they needed to cover, like clothing (with minimum requirements to ensure they did not skimp too much) and personal entertainment. “They got paid every two weeks, just like a paycheck,” Audrey explained.

Even with these foundational efforts, their innate tendencies shone through. Her daughter consistently managed her money well, while her son often struggled to keep pennies in his pocket. This early observation highlighted that a one-size-fits-all approach might not always work.

Making “Invisible” Money Real

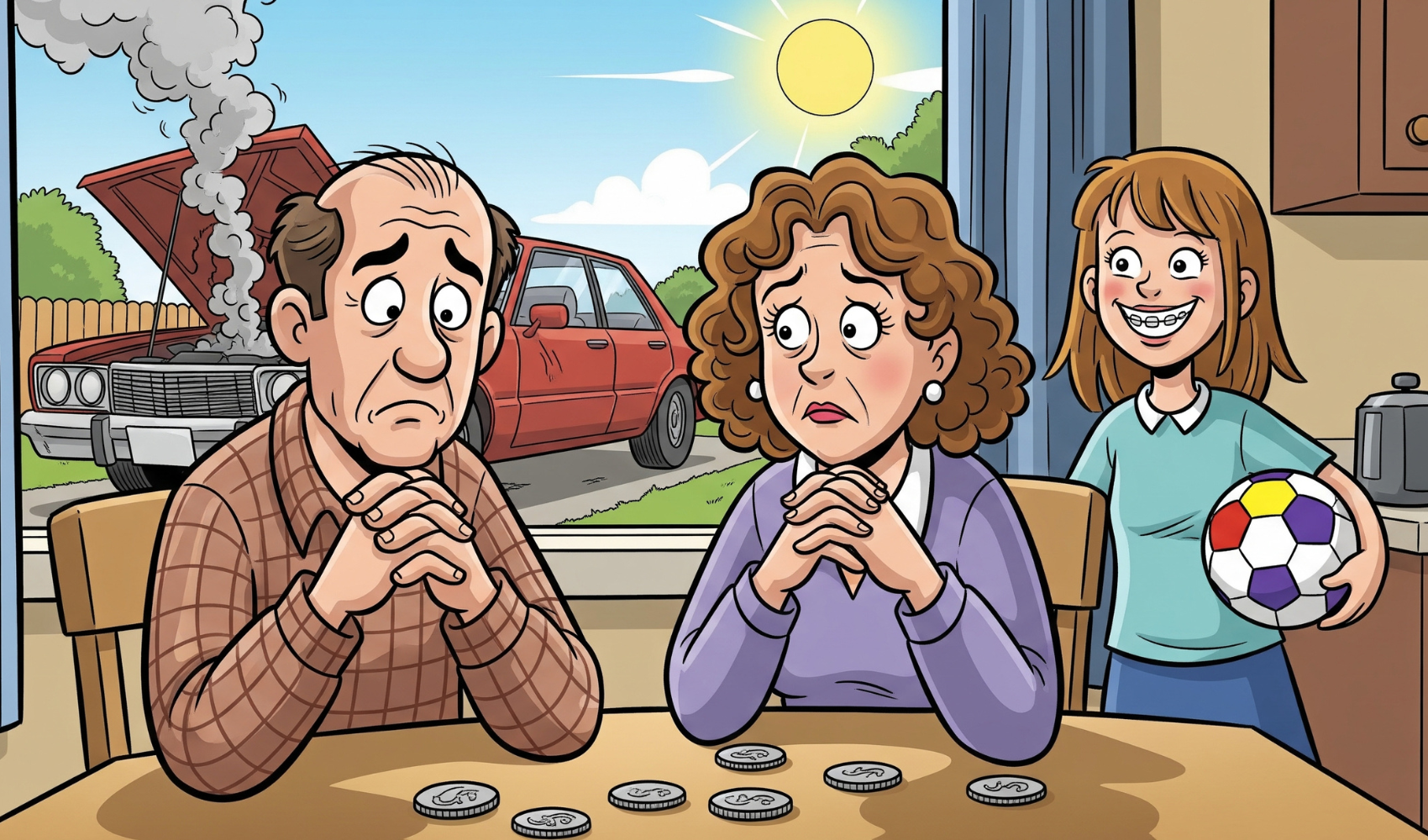

A significant hurdle for many young adults today, Audrey notes, is the intangible nature of money. “Money is not real [to them],” she explained. “They don’t see their money. It never comes to them. They never spend cash. They don’t write checks, right? It’s all immediate.” This lack of physical interaction can make it difficult for young adults to grasp the reality of their spending and its consequences.

Audrey’s son experienced this firsthand. As an emotional spender, he found himself accumulating significant debt through “buy now, pay later” deals and high-interest payday loans. The ease of digital transactions masked the true impact on his finances until the debt became overwhelming.

Finding the Right Tools and Support

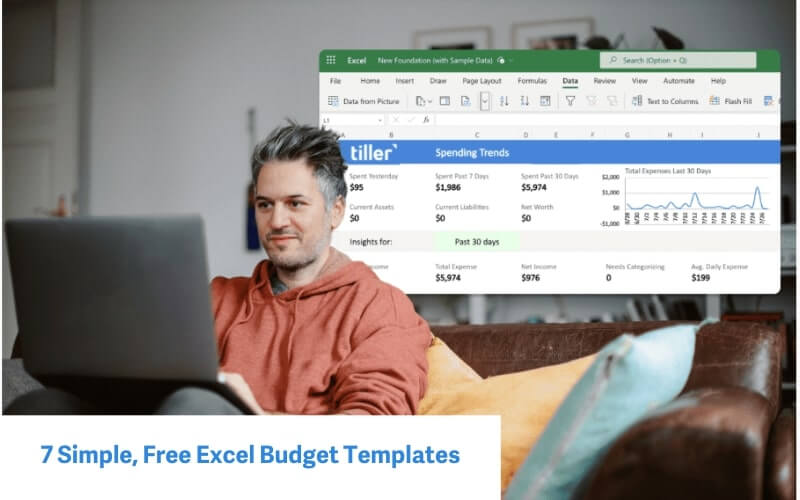

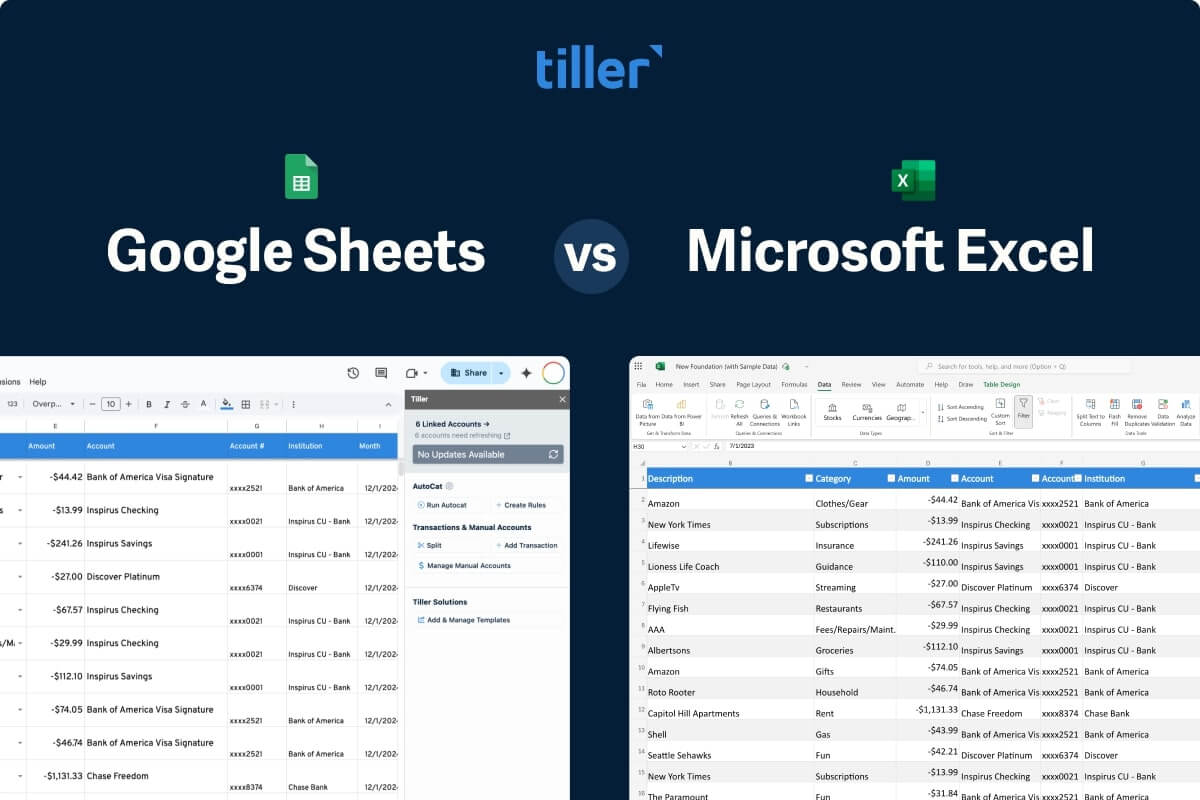

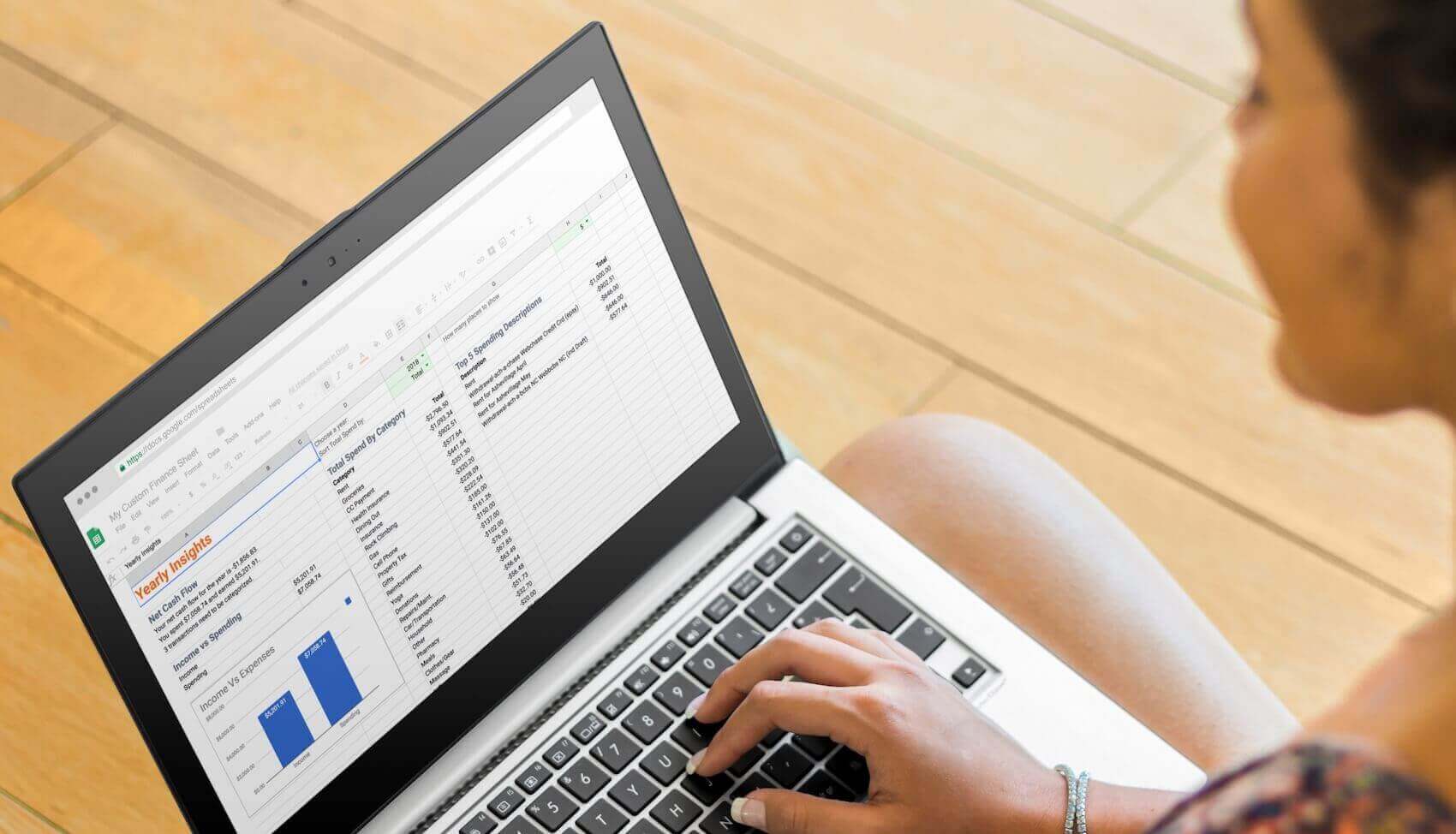

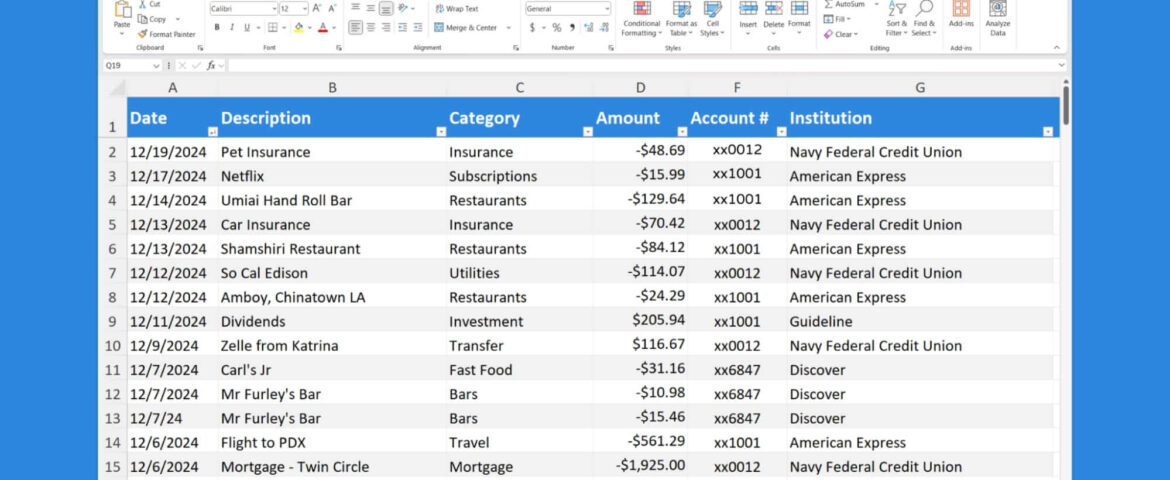

Recognizing the need for a clearer financial picture, Audrey introduced both her children to Tiller. Interestingly, they each adapted the tool to their own preferences, showcasing Tiller’s flexibility. Her daughter, the natural saver now navigating finances with her wife, preferred to manually enter transactions into her Tiller spreadsheets. “She says, ‘I want to enter my transactions… I want to see them, touch and feel them, enter them into a spreadsheet,'” Audrey shared. This hands-on approach helped her feel connected to her financial data.

Her son, on the other hand, benefited greatly from Tiller’s automated bank feeds. He needed to see where his money was going without the friction of manual entry. “My son uses the import function on the templates. And that’s, and it’s finally working. He’s really finally getting it,” Audrey said. Seeing his spending clearly categorized in Tiller was a breakthrough. To further solidify his understanding for certain categories like food, they even circled back to a more tangible method. “Go to an ATM machine, get the cash, put it in your pocket,” she advised him, so he could physically see his budget diminish with each purchase.

Sparking Conversations About Value-Based Spending

Audrey candidly wishes she had emphasized value-based spending more when her children were younger. It was a concept her husband introduced into their own lives: making a budget, then reviewing spending at year end to see if it aligned with their stated values, like family and travel.

This principle became particularly relevant for her son. Within his Tiller budget, he created a category for “unneeded wants” This simple act of tracking and categorizing prompted important questions: “What have you spent on things you don’t need this month? And is that really where you want to be spending your money and your time?” Audrey explained. This helped him connect his spending to his broader life goals and values.

Navigating New Life Stages and Financial Shifts

Financial needs and perspectives often change dramatically with new life stages. Audrey’s daughter, for instance, faced a new financial landscape after getting married, having a baby, and navigating significant school debt. Her wife’s desire to stay home with their child meant they needed to critically re-evaluate their finances. “Now we’re going to completely change our financial outlook and we have to pay attention to our money,” Audrey described their realization. Fortunately, her daughter’s positive early experiences with budgeting, including managing finances while working in Thailand, equipped her to tackle these new challenges proactively.

The Crucial Art of Guiding, Not Rescuing

Perhaps one of Audrey’s most emphatic pieces of advice for parents is this:

“Don’t save them.”

When adult children encounter financial difficulties, the parental instinct is often to step in and fix it. However, Audrey cautions against this. “Help them figure out how to get out of trouble. Don’t pay off their debt for them… they just won’t get it.”

She stresses the importance of letting them experience the consequences and learn to navigate their own way out, with guidance and support, of course. “They need to live it every day,” she said, comparing it to teaching someone how to fish rather than just giving them a fish. This approach, while sometimes difficult for parents, helps adult children develop maturity and a more profound understanding of their relationship with money. Embracing failure as a learning opportunity is key.

Even Savers Need Guidance

While spenders might present more obvious challenges, natural savers also have lessons to learn. Audrey pointed out a potential pitfall for those who are very good at saving: “Sometimes I think really good savers don’t spend the money to their own detriment. They make their lives harder because they don’t want to spend the money.” Parents can help these children understand that it is okay to spend and enjoy their money, especially when it aligns with their budget and values, without feeling undue stress or guilt.

Fostering Financial Independence

Helping adult children navigate their finances is an ongoing journey. Audrey’s experiences show that combining consistent financial education, the right tools tailored to individual needs (like a flexible spreadsheet budget system), and open conversations about values can make a significant difference. Most importantly, empowering them to learn from their own experiences, even the tough ones, builds the financial resilience they need for a lifetime.

Start Them Budgeting Right: Tiller is Free for College Students

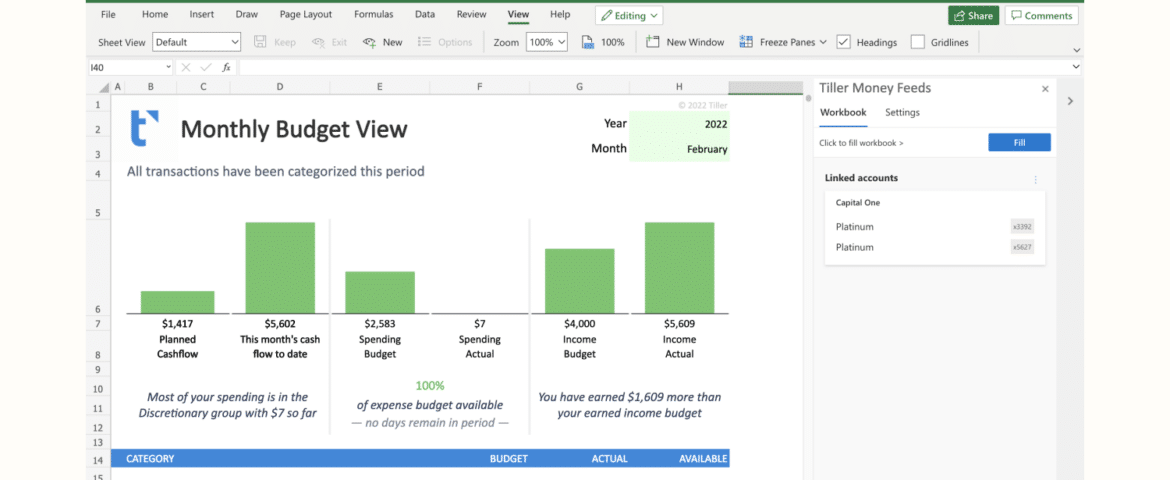

Audrey’s experiences underscore the importance of equipping young adults with the right tools and understanding to confidently manage their money. For college students ready to take control of their finances and get off on the right foot, Tiller offers a powerful head start. By providing a clear, automated way to see exactly where their money is going and enabling them to build flexible budgets in familiar spreadsheets, Tiller makes personal finance accessible and empowering. And to support students in this crucial learning phase,

Tiller is available completely free of charge to all enrolled high school or college students.

This provides an invaluable opportunity for them to develop smart budgeting habits early, gain true visibility into their spending, and build a solid financial foundation that will benefit them long after graduation.

Gift Tiller and Give Financial Confidence

Ready to empower a young adult in your life with true financial clarity? You can gift two years of Tiller through our special discounted offer for just $100, a 36% savings that helps them build a strong financial foundation. Tiller connects directly to their bank accounts, credit cards, and investments, automatically bringing all their transactions and balances into a spreadsheet they own. This means they can easily see where every dollar is going, quickly categorize expenses for things like rent, food, or entertainment, and build a budget that actually works for their lifestyle. They’ll gain a clear, personal picture of their money, helping them confidently manage their cash flow and plan for the future.