Tiller’s Five Steps to Financial Well-Being

The most financially successful people aren’t necessarily the wealthiest—they’re the ones with a personalized system—a clear, proven set of steps that helps them stay organized, prepared, and moving toward what matters most.

At Tiller, we believe that money matters because life matters more. When we are in better control of our money we can align our money with our values, profoundly improving our lives and our community.

We’ve worked with thousands of customers over the years, and we’ve identified five essential steps to achieving true financial well-being, regardless of your income, goals, or starting point.

Here are the five steps—and how Tiller helps you personalize, automate, and master each one:

Step 1: Understanding Your Money

Know what’s going on with your finances.

This step is about awareness without judgment. You’re simply gathering information.

Much of this information may be familiar, but seeing the full picture all together can reveal surprising insights.

- Cash flow: How much money is coming in and going out each month?

- Balances: What do you have in checking, savings, and investment accounts?

- Spending patterns: Where is your money going? Most people know what they earn but have only a vague sense of where it goes.

- Savings: How much are you setting aside, and for what?

- Debts: What do you owe, and at what interest rates?

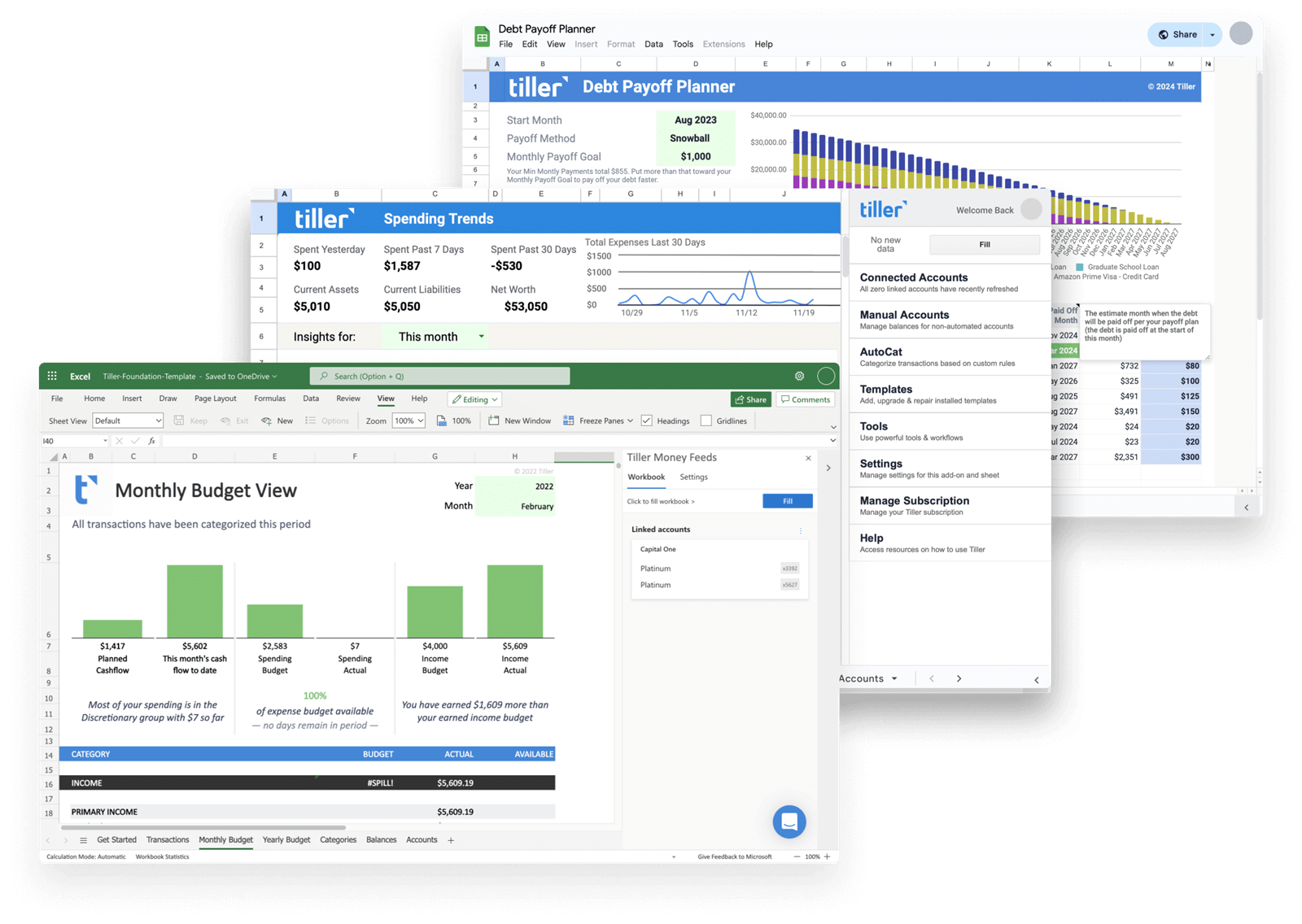

How Tiller Helps

Tiller automatically pulls all your financial data—your bank accounts, credit cards, loans, and investments—into one place so that you can see everything at a glance.

And unlike apps that show you pre-built dashboards, Tiller’s spreadsheets let you dig into your data however works best for you.

Get started:

Step 2: Preparing for the Unexpected

Build your safety net.

Unexpected expenses like medical bills, car repairs, or even job loss can derail anyone’s finances. Being prepared makes the difference between a setback and a crisis.

This step is about building in protection:

- Emergency fund: Standard financial advice is to start with $1,000, then work toward 3–6 months of essential expenses.

- Insurance coverage: Do you have the right insurance for your situation? Consider home/renters insurance, health insurance, auto, etc.

How Tiller Helps

You can set up charts or spreadsheets for each funding goal and track your progress. And you can easily see how much you’re spending on insurance each year—and on what kinds of insurance—so that you can make sure you’re adequately protected.

Resources:

Step 3: Taking Command of Your Debt

Understand your debt and make it work for you, not against you.

Debt isn’t inherently good or bad—it’s a tool. But like any tool, it can be used wisely or poorly. The key is being in command of it rather than feeling controlled by it.

Good Debt vs. Bad Debt

Good (or strategic) debt is typically:

- A mortgage on a home you can afford and plan to live in long-term

- Student loans that expand your opportunities and earning potential

- Sometimes car loans, if it’s a reasonable vehicle within your means that you need for work or essential transportation

Bad (or non-strategic) debt includes:

- High-interest credit cards carrying balances month to month

- “Buy now, pay later” schemes that encourage spending beyond your means

- Loans for depreciating purchases you can’t really afford, including some car loans

Getting in Command

Being in command of your debt means:

- Knowing exactly what you owe, to whom, and at what rates

- Having a plan to eliminate high-interest debt

- Making strategic decisions about when debt makes sense and when to wait and save

- Staying current on the debts that are working for you (like your mortgage)

How Tiller Helps

Tiller lets you see all your debts in one place, track payoff progress for each account, and use debt paydown calculators to create a strategic repayment plan.

Tools for debt management:

Step 4: Saving for Your Future

Build the life you want tomorrow by making smart choices today.

Once you understand your money, have some emergency protection, and have a handle on your debt, you’re ready to save for your future.

Why Saving Matters

The simple truth is that money saved today and invested wisely grows over time. Saving 20% of your income instead of 10% can double your retirement savings or let you retire years earlier.

Time is your greatest asset when it comes to saving. The earlier you start, the more your money can grow through compound returns.

How Much Should You Save?

There’s no single right answer. It depends on your life stage and circumstances.

If you’re raising young children, you might save less because you have important expenses to support your family. If you’re in a higher-earning season, you might save more.

A general guideline is to aim for 10–20% of your income when you can. But don’t let perfection be the enemy of progress. Saving 3% is much better than saving 0%.

Where to Put Your Savings

Proven strategies include:

- Keep your emergency fund in a high-yield savings account where you can access it immediately

- For long-term savings (retirement, kids’ college), consider low-cost index funds that give you broad market exposure

- Diversify across U.S. stocks, international stocks, and bonds in proportions that match your risk tolerance and timeline

How Tiller Helps

With Tiller’s customizable spreadsheets, you can see all your accounts in one place, track your savings rate over time, monitor investment account balances, and see your net worth grow as you build wealth.

Start building your future:

Step 5: Spending With Purpose

Transform money from a tool for survival into a tool for impact and fulfillment.

Once you’ve taken care of steps 1–4, you reach a place of real financial freedom. You’ve put yourself on a solid foundation and you’re ready to help others do the same.

This final step is about:

Spending Aligned With Your Values

Does how you spend money reflect what matters most to you? Are you investing in experiences that bring you alive? Supporting businesses and causes you believe in?

Having a Healthy Relationship With Money

This means recognizing when you have enough. It means letting go of scarcity thinking when you’re no longer in scarcity. It means not defining your personal worth by your net worth.

Contributing to Others

When you’re financially stable, you have the capacity to be generous. Whether it’s helping a family member, supporting a cause you believe in, or mentoring someone earlier in their journey, your financial security creates opportunities to make a real difference.

This is where money transcends being just a tool for survival and becomes a way to create meaning and impact.

How Tiller Helps

Use category tracking to see exactly where every dollar goes, then adjust your spending to reflect what matters most—whether that’s travel, education, sustainability, or generosity.

Align money with meaning:

Your Journey Is Unique

These five steps aren’t a strict sequence. Life is messier than that. You might be working on multiple steps simultaneously. You might move backward sometimes before moving forward again. That’s OK.

What matters is that you’re making progress, that you’re being intentional, and that you’re not facing these challenges alone.

Tiller is here to help you navigate your financial journey.

Financial well-being isn’t about having everything figured out. It’s about knowing where you are, where you want to go, and having the tools and support to get there.

Ready to build your personalized system?

And be sure to stay tuned to the Tiller blog. We continue to post articles to help you with each of the five steps.