Teaching our adult or soon to be adult children about budgeting and personal finance is one of the most valuable lessons we can offer. As they step into independence, a solid understanding of how to manage their money can make all the difference in their future success and peace of mind. But let’s be honest, these important conversations can sometimes feel a bit like a lecture, for them and for us. The challenge is often finding a way to make these crucial lessons engaging and truly stick.

Adult Children Ready to Move Out

That is exactly the situation I find myself in. I am a mom of five, and my two oldest daughters are getting ready to move out into their first apartment. It is an exciting milestone, yet it comes with significant new financial responsibilities. Before they packed their bags, I told them we absolutely had to sit down for a real money talk. A key part of this was setting up their budgets in Tiller, especially since I will be helping them with rent initially. They begrudgingly agreed, as you might imagine. I could already picture the scene: a slightly tense conversation, maybe a few glazed over eyes. I knew I needed a different approach. How could I make this essential learning experience less of a chore and more, well, fun?

Gemini Pro 2.5 Canvas Financial Literacy Game

Creating an Interactive Experience as a Game

In 2025, Artificial Intelligence (AI) offers many new possibilities. I wondered if Google Gemini could help me create a gamified approach for the financial talk with my daughters. I learned that with Gemini Canvas, you can describe the interactive quiz or game you envision, and Gemini helps you to build out the framework and even suggest ideas.

Why a Custom AI-Assisted Game for Financial Prep?

Creating a personalized game or quiz, especially with the help of AI tools, offers some distinct advantages when preparing young adults for financial independence:

- Tailored to Their Journey: Unlike generic advice, you can design the game around the specific financial situations your children will face. Think questions about sharing utility costs, understanding a lease agreement, or saving for apartment essentials. This makes the learning immediately relevant.

- Active Learning, Not Passive Listening: A game encourages participation. Instead of just hearing about budgeting principles, they are actively thinking through scenarios and making choices within the game. This active engagement helps solidify their understanding.

- Makes a Daunting Topic Approachable: Let’s face it, personal finance can seem intimidating. A game format can lighten the mood, reduce anxiety, and make complex topics easier to digest.

- You Control the Narrative: You can ensure the game emphasizes the values and financial habits you wish to impart, all within a supportive and controlled environment.

Prompt for a Game

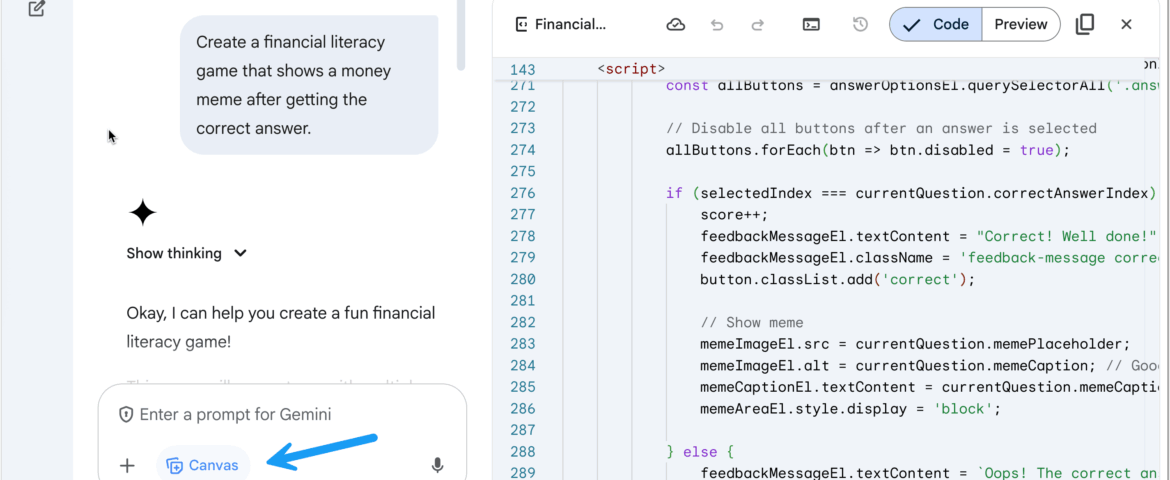

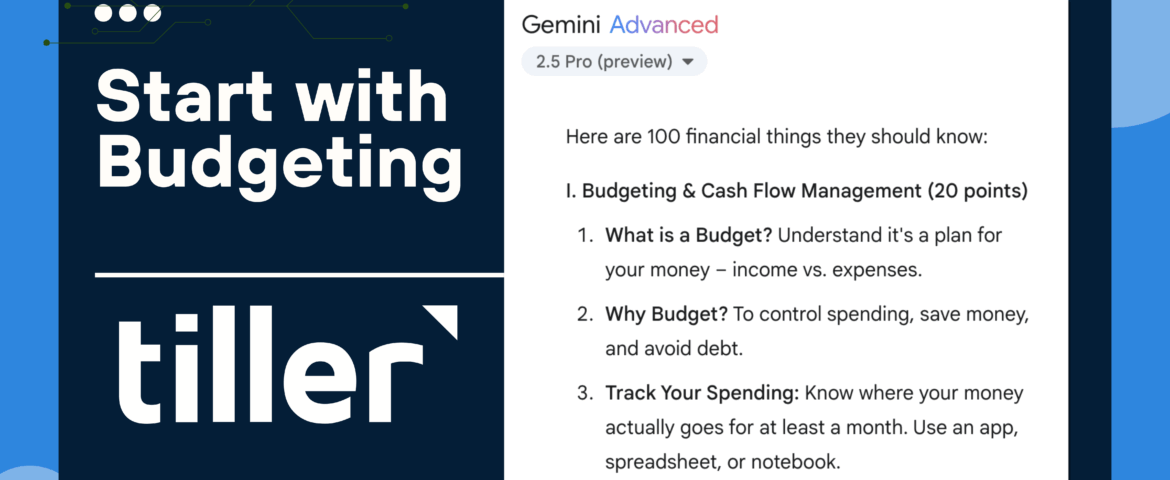

Using Google Gemini, I prompted it to

“Create a financial literacy game that shows a money meme after getting the correct answer.”

This was literally my full prompt and the prototype was very impressive!

While the AI tool’s output was code, previewing it was easy. Clicking the ‘Preview’ tab showed me a fully functioning game. I then copied that code, pasted it into an HTML block on my WordPress site, and it just worked immediately, the first time. The initial version of the game I created is shown above.

What’s helpful is that I can easily edit the questions and responses. This allows me to tailor the content specifically to what I want to share with my adult children before they move out. This way, I am not using generic questions that someone else thought were important. Instead, the game builds on the life lessons I have personally learned.

Creating a More Robust Interactive Game Using AI

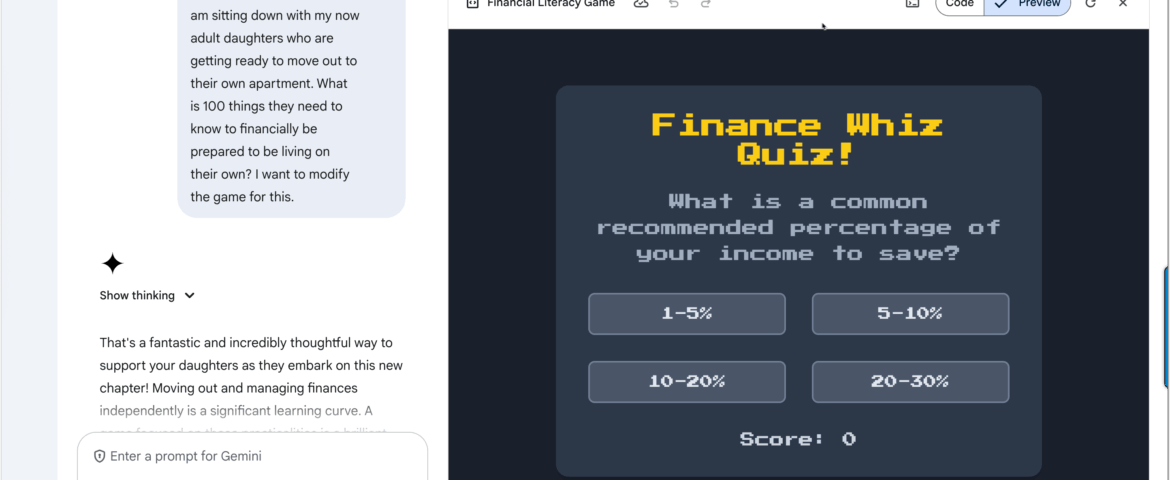

While I could simply edit the questions in the code and be good to go, I wanted a more robust conversation with my daughters. I asked Google Gemini to brainstorm topics for me.

This is fantastic. However, I am sitting down with my now adult daughters who are getting ready to move out to their own apartment. What is 100 things they need to know to financially be prepared to be living on their own? I want to modify the game for this.

100 Financial Topics to Discuss with my Adult Children

Gemini quickly provided 100 topics to discuss with my children. Honestly, even that list did not feel like nearly enough. The sheer number of things to budget for, along with all the ways to be financially savvy, can be overwhelming. In hindsight, it made me realize my best advice is this: start teaching financial literacy from a very young age. There are so many crucial financial tips to share before children are out on their own.

View the list of 100 financial tips Gemini brainstormed.

Budget with Tiller

My first plan of action was to set up each of my daughters with a free Tiller student account. I was pleased to see that Gemini’s brainstorming list of essential topics also began with the importance of creating a budget. From my own experience, it is always surprising how quickly those small, everyday expenses can accumulate. My hope is that as they use Tiller, they will see this for themselves. Perhaps this insight will encourage them to eat out a little less often and think more about increasing their savings. Tiller will certainly help them visualize that connection.

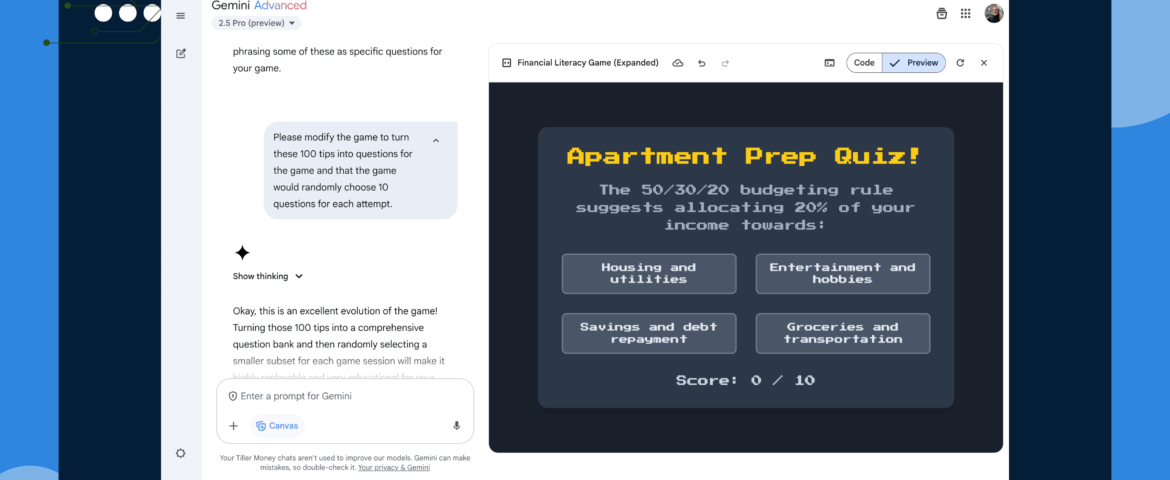

Modify the Prompt to Include More Robust List

Once I was satisfied with the brainstorming list I prompted Gemini to

Please modify the game to turn these 100 tips into questions for the game and that the game would randomly choose 10 questions for each attempt.

Try the Game: Use it with Your Adult Children

It was genuinely surprising how quickly it all came together. After refining the list of topics with Gemini, I gave it a new prompt to incorporate these into the game structure we had started with, asking for ten random questions per attempt. In what felt like no more than about three minutes of this focused prompting, I had a fully customized game. This was not just any game; it was a tool I created, with AI assistance, specifically for my daughters. It is designed to spark essential conversations about budgeting, saving, and all the financial realities that come with apartment life, hopefully making them feel more prepared and confident as they embark on this new chapter.

Paving the Way for Financial Confidence

Preparing our adult children for the financial responsibilities of independence can feel like a big task, but as I discovered, we are not alone in figuring out how to make these lessons stick. Today’s Artificial Intelligence tools, like Google Gemini, offer accessible and creative avenues to transform potentially dry financial talks into engaging, interactive experiences. Crafting a custom game tailored to my daughters’ upcoming move has given me a fresh, effective way to connect with them on these vital topics.

More importantly, this playful approach serves as a fantastic entry point to real world financial management. The concepts we will explore in our game are the very same ones they will navigate daily using their Tiller spreadsheets. Tiller provides the ongoing clarity and control they will need to put these lessons into practice, see their progress, and build lasting confidence in their financial decisions. The AI helps make the learning fun and personalized; Tiller provides the robust platform for them to apply that knowledge and truly own their financial future.

If you are looking for new methods to discuss money management with the young adults in your life, I encourage you to explore how AI might help you create your own personalized learning tools. Combined with the solid, transparent foundation that Tiller offers for day to day budgeting and financial tracking, you can help them build a strong financial future, one insightful conversation, one engaging game, and one organized spreadsheet at a time.