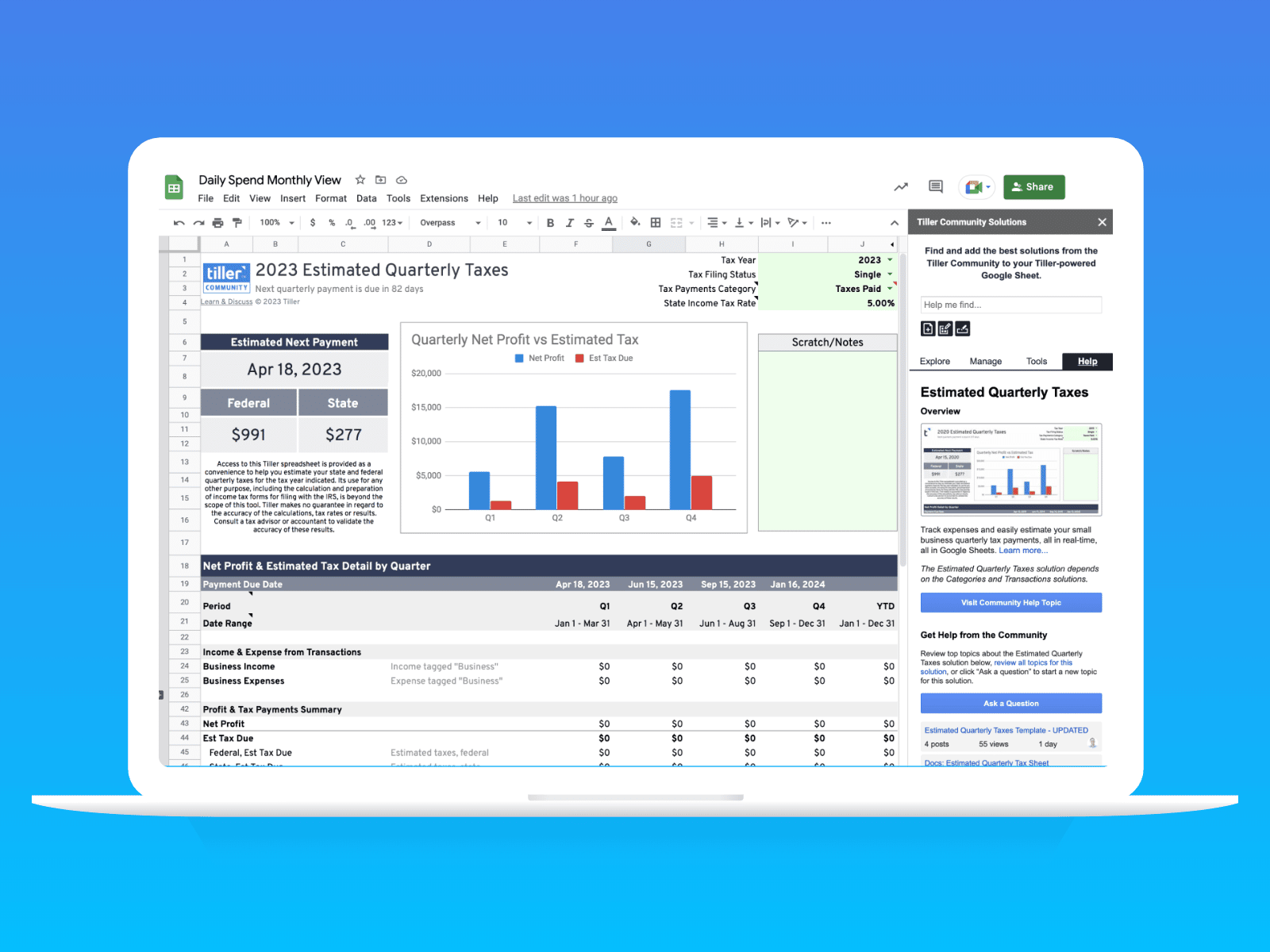

Note – Find 2020 Quarterly Estimated Tax Due Dates here →

Self-employed individuals typically must pay quarterly estimated taxes on a schedule established by the IRS.

What are the quarters?

First Quarter – The first quarter of a calendar year is made up

of January, February, and March.

Second Quarter – The second quarter of a calendar year is made

up of April, May, and June.

Third Quarter – The third quarter of a calendar year is made up

of July, August, and September

Fourth Quarter – The fourth quarter of a calendar year is made

up of October, November, and December.

Here are the quarterly estimated tax payment due dates for 2019:

April 15, 2019: Income tax due date AND the due date for your first quarterly estimated tax (QET) payment. In April, you’ll pay quarterly estimated taxes on the income you made in January, February, and March 2019.

June 17, 2019: This is when you’ll pay quarterly estimated taxes on the income you made in April and May 2019.

September 16, 2019: Quarterly estimated taxes for the months of June, July, and August 2019 are due on this date.

January 15, 2020: Quarterly estimated taxes for the months of September, October, November, and December 2019 are due on this date.

|

Date |

Tax Due |

| January 31, 2019 | 1099- MISC due to Contractors |

| February 28, 2019 | 1009- MISC due to IRS (for each contractor) |

| March 15, 2019 | S Corporation Tax |

| April 15, 2019 | Personal Income Tax |

| April 15, 2019 | Quarterly Estimated Tax |

| June 15, 2019 | Quarterly Estimated Tax |

| September 16, 2019 | Quarterly Estimated Tax |

| January 15, 2020 | Quarterly Estimated Tax |

The IRS tax calendar has all the dates you’ll need and more.

In Google Calendar (or calender of choice), you can also subscribe to the IRS Tax Calendar for Businesses and Self-Employed.

Income tax dates:

Income tax is generally what we think of when we think of taxes. Key dates:

March 15, 2019: Tax due date for “S” corporations and corporations. It comes a full month before the typical income tax due date.

April 15, 2019: Your personal income tax is due on this day; so is your sole-proprietor or a single-member LLC income tax.

This information is for educational purposes only. Always consult an accountant or tax professional for information tailored to your specific business.

Are the taxes due that those dates, or can hey be post marked by that due date?

I came here to ask the same thing. I used to work in accounting and I prepare my own taxes. It was always the postmarked date, not the date they received it. Now that most people file and pay electronically, they have to pay no later than the due date. Up until now, I have been paying federal and state, tax returns and estimated, with paper forms and checks and mailing them on or close to the due date and getting a receipt from the post office.

From the IRS website: “If you mail your estimated tax payment and the date of the U.S. postmark is on or before the due date, the IRS will generally consider the payment to be on time. If you use IRS Direct Pay, you can make payments up to 8 p.m. Eastern time on the due date. If you use a credit or a debit card, you can make payments up to midnight on the due date.”

Multi Member LLC is due March 15th. You should add that.