The arrival of a first real paycheck is a landmark moment. It is a tangible symbol of independence, a validation of years of hard work through school, and the official start of your adult life. For many, this moment brings a rush of excitement and a dizzying array of possibilities. Suddenly, the things you have always wanted seem within reach. Yet, this excitement often shares space with a quiet, persistent sense of being overwhelmed. What do you do now? How much should you save? How much can you spend?

These are not just questions about numbers. They are questions about the kind of life you want to build. To explore this pivotal stage of life, Tiller’s Peter Polson recently sat down with Eleanor, a recent college graduate who is just a few months into her new career in New York City. Their conversation provides a powerful framework for any young adult standing at the threshold of their financial journey. It is a discussion that moves beyond simple budgeting rules and dives into the mindsets, strategies, and habits that create a lifetime of financial wellbeing. This guide captures the essential lessons from their talk, offering a roadmap to navigate your finances with confidence and purpose.

The Foundation: Living with Awareness

The first step in any journey requires knowing your starting point. In personal finance, this means understanding where your money is going. Peter began the conversation by emphasizing a timeless principle: tracking your spending and living below your means. This concept sounds simple, yet it is one of the most difficult to master in a world designed to encourage constant consumption.

The Reality of Saving

When Peter mentioned the common guideline of saving at least ten percent of your income, Eleanor’s response was refreshingly honest. She admitted that while she wants to, it does not happen with every single paycheck. Life is busy, new expenses constantly pop up, and sometimes saving feels like a task for another day. Her experience reflects the reality for millions of young people. The pressure to save can feel immense, and when you cannot meet an arbitrary goal, it is easy to feel like you have failed and give up entirely.

The key takeaway is not to fixate on a perfect percentage from day one. The true goal is to build a habit of awareness.

It begins with simply watching your money. When you use Tiller showing you every transaction, you give yourself a second look. You see the morning coffees, the spontaneous online purchases, and the subscription fees add up. This is not an exercise in judgment. It is an exercise in data collection. You cannot make informed decisions without good information. By simply tracking your spending, you move from a passive participant in your financial life to an active, engaged observer. This awareness is the bedrock upon which all other financial habits are built. You begin to naturally see where your money aligns with your values and where it does not, empowering you to make small, impactful changes over time.

The Superpower: Understanding the Time Value of Money

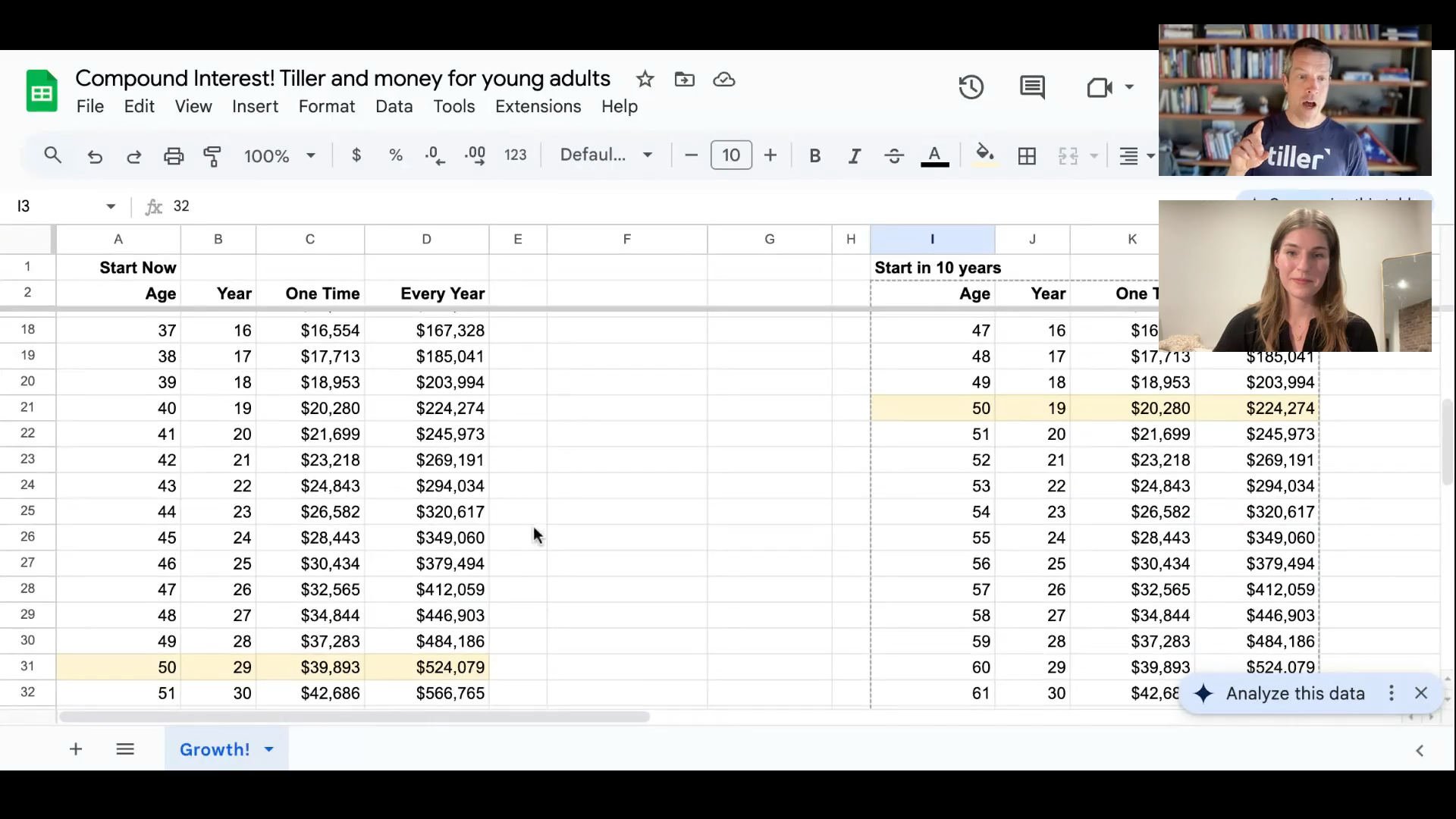

If awareness is the foundation, then understanding the time value of money is the superpower. It is a concept that can feel abstract, especially when you are young and retirement seems like a distant mirage. To make it concrete, Peter shared a simple spreadsheet that visually demonstrated the profound impact of compound interest. This is arguably the most critical mathematical principle a young person can grasp.

The Astonishing Power of Compounding

Imagine you are 22 years old. You decide to invest $500 a month for just one year, totaling $6,000, and then you stop. Assuming a conservative seven percent annual return, which historically mirrors the broad stock market, that single $6,000 investment would grow to over $10,000 by the time you are 30. That is impressive, but the real magic happens when you make it a consistent habit.

Peter’s spreadsheet showed what happens if you continue to invest that 500 dollars every month. By age 50, your consistent contributions would blossom into over $500,000.

By age 65, that figure would approach an incredible 1.5 million dollars.

This is the power of your money earning money, and then that new money earning even more money, year after year.

The High Cost of Waiting

The demonstration then took a crucial turn. Peter adjusted the scenario. What if you decide your 20s are for having fun, and you delay saving until you are 32? By waiting just ten years to start the exact same saving habit, the outcome changes dramatically. The 1.5 million dollar nest egg at age 65 shrinks to about $760,000.

You have saved for ten fewer years, but you have lost nearly half of your potential wealth.

This illustrates the great paradox of saving. It is hardest to save when you are young because your income is typically at its lowest. However, every dollar you save in your 20s is exponentially more powerful than a dollar you save in your 40s or 50s. It has decades to work for you, to compound and grow. Grasping this concept changes your perspective entirely. Saving is no longer about restriction. It becomes an act of profound self investment. You are not just putting money away. You are deploying your most powerful financial asset: time.

The Mindset: Viewing Money as a Tool

How we think about money shapes every financial decision we make. Our culture often portrays money as a scoreboard for success or a direct ticket to happiness. Marketers, as Eleanor noted, are incredibly adept at reinforcing this message, filling our social media feeds with targeted ads that promise a better, happier life with just one more purchase.

The Water Analogy

Peter offered a different perspective, framing money not as a goal, but as a tool. He used the analogy of water. If you are dehydrated and have no access to clean water, it becomes the most important thing in your world. Your entire focus narrows to quenching that basic need. However, once you have ample, clean water to drink and use, your focus shifts to other, more meaningful things in life. If someone then offered you billions more gallons of water, it would not necessarily make you happier. In fact, it might become a burden to manage.

Money functions in a similar way. A certain amount of it is essential to provide for our basic needs like housing, food, and healthcare. It creates a platform of stability from which we can operate. Beyond that point, research consistently shows that more money has a diminishing correlation with day to day happiness. The key is to see money for what it is. It is a resource that can build a house, fund an education, or create security for your future. It is a tool for living, not the purpose of life itself.

The Pitfalls: Navigating Modern Debt

In today’s digital world, it has never been easier to spend money you do not have. The rise of “buy now, pay later” services, coupled with the ever present availability of credit cards, creates a landscape fraught with financial traps. This world, as Peter lamented, is designed to encourage impulsive behavior that can quickly lead people into a deep hole of debt.

The Credit Card Paradox

Eleanor mentioned her own reluctance to use credit cards, fearing she would forget about the bill and accumulate debt. This is a wise and healthy fear. It is painfully easy to let a small balance roll over, only to see it balloon under high interest rates. However, Peter pointed out the paradox of our financial system. In order to qualify for “good debt,” such as a mortgage to buy a house, you need to have a history of using credit responsibly.

This creates a challenging balancing act. The solution lies in discipline. One can build a positive credit history by using a credit card for small, planned purchases and, crucially, paying the balance in full every single month. By doing so, you reap the benefit of building credit without paying a single cent in interest. You are using the system to your advantage rather than letting it take advantage of you. The goal is to avoid lifestyle creep, the subtle tendency to increase your spending with every increase in income. Living at or below your means, especially when it comes to credit, is a non negotiable rule for long term financial health.

The Strategy: Building Your Financial Toolkit

Armed with the right mindset, you can begin building a practical toolkit for managing your money. This involves more than just a single checking account. It means creating a system of accounts designed for specific purposes, which brings intention and clarity to your financial life.

Your Emergency Fund

The first and most important tool to build is an emergency fund. This is a dedicated savings account containing three to six months’ worth of essential living expenses. This money is not for vacations or down payments. It is your personal safety net. If you unexpectedly lose your job, face a major medical expense, or need a critical car repair, the emergency fund is there to see you through without forcing you into debt or a panic. Eleanor noted that even the name “emergency fund” makes the money feel more accessible for its true purpose. It is a fund that provides resilience and the peace of mind to navigate life’s inevitable surprises.

Goal Oriented Savings

Beyond the emergency fund, Peter advised setting up separate savings accounts for your major goals. It is incredibly easy to open multiple named accounts online. You could have one for a “New Car,” another for “Future House,” and a third for “European Vacation.” This strategy leverages a powerful psychological principle. When you see a specific account balance growing for a specific goal, it makes that goal feel more real and attainable. You are less likely to raid your “New Car” fund for an impulse purchase when you have given it a clear job to do. This method transforms saving from a vague, abstract idea into a series of concrete, achievable projects.

The Purpose: The Transformative Power of Giving

The final piece of the financial puzzle is perhaps the most impactful. It involves a mindset shift from accumulation to contribution. After you have established a system for living below your means and saving for your future, incorporating giving into your financial plan can profoundly reframe your relationship with money.

Giving as a Habit

Giving can take the form of time or money. When you are young, you may have more of one than the other. The key, Peter stressed, is to build the habit early. It starts with identifying the causes that resonate deeply with you. For Eleanor, this was environmental restoration and women’s access to healthcare. For others, it might be local education, animal welfare, or global disaster relief.

When you begin to direct a portion of your resources toward these causes, something remarkable happens. Money ceases to be a purely personal resource and becomes a vehicle for expressing your values in the world. Peter shared a staggering fact from his work with Doctors Without Borders: it can take as little as five dollars to treat a child with pneumonia, a disease that claims hundreds of thousands of lives each year. This is not to induce guilt, but to illustrate the incredible leverage that even small amounts of money can have.

Building the habit of giving, even with modest contributions, opens your heart to the needs of the world. It is a constant reminder that your financial wellbeing is connected to the wellbeing of your community and the world at large. It solidifies the idea of money as a tool, one capable of not only improving your own life but also the lives of countless others.

A Conclusion for Your Beginning

Your financial journey is a marathon, not a sprint. The early years are not about achieving perfection. They are about building a solid foundation of awareness, knowledge, and habits. The conversation between Peter and Eleanor provides a clear and compassionate guide for this process. It begins with the simple, consistent act of tracking your money. It accelerates with a deep understanding of compound interest, your greatest ally. It is guided by the mindset that money is a powerful tool to be used with intention, not a measure of your worth. It is protected by a healthy aversion to debt and a strategic system of savings. Finally, it is enriched by a spirit of generosity that connects your financial life to a greater purpose.

The Gift of Financial Clarity

You do not need to be a financial genius to succeed. You just need to be engaged. You need to be curious and willing to learn. As you move forward, remember that Tiller is here to support you. We offer a free subscription for students to help you start on the right foot. For those who want to help a loved one, we also have a special offer to gift two years of Tiller to a recent graduate. You have the ability and the tools to take command of your money and build a life of clarity, confidence, and purpose. The journey starts now.