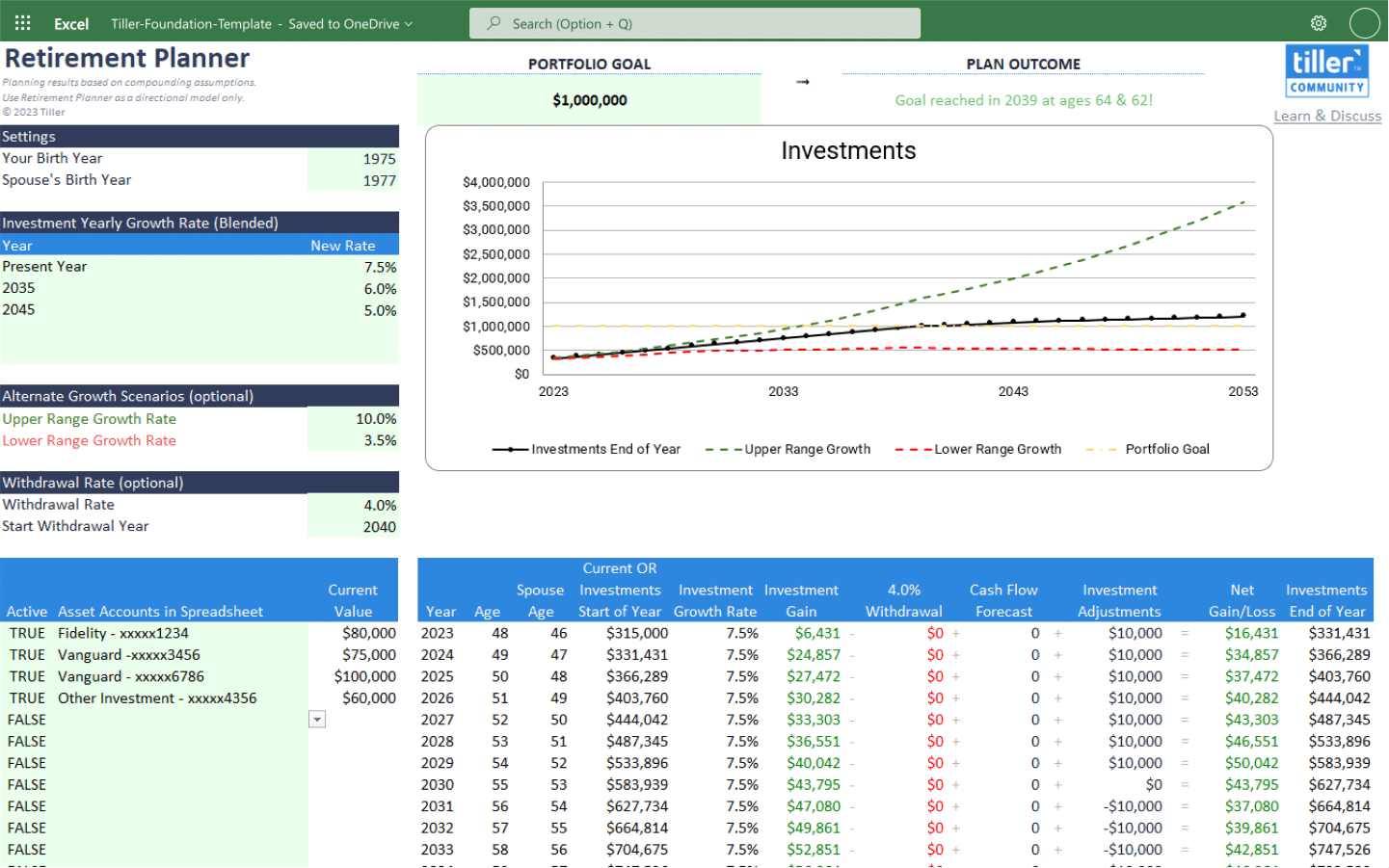

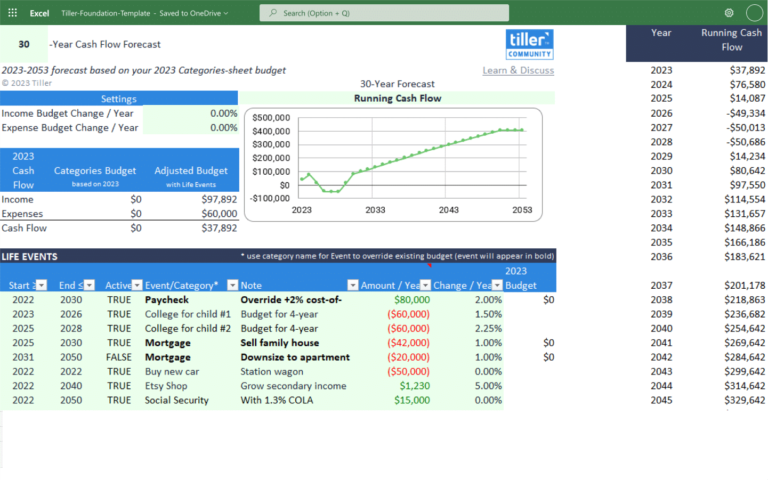

The Retirement Planner solution works well in combination with the Cash Flow Forecast sheet. Any expected future income or expenses (e.g. college expenses for a child, a home or car purchase, etc) should first be entered on the Cash Flow Forecast sheet.

The Retirement Planner uses your cash flow information from the Cash Flow Forecast sheet then adds Investments totals, Investment Growth, Withdrawal rates, and Transfers/Adjustments to the forecast.

The sheet makes many compounding assumptions about the future— listed in the Google Sheets post— and thereby should only be used as a directional model.

Benefits

- Quick & easy setup (only a handful of inputs are required)

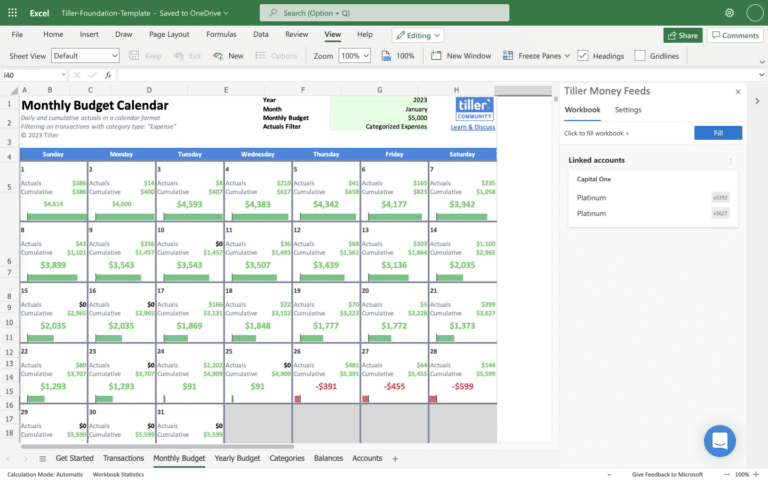

- Presents forecast by year in both chart and table formats

- Projects when you will reach a your Portfolio Goal

- Responsive scenario planning with instantaneous updates to plan changes

- Renders multiple growth rate scenarios

- Integrates with your existing account balances and Cash Flow Forecast

- Can model changing risk profile

Installation

This template requires a free trial or active subscription of Tiller to try.

- Launch Tiller Money Feeds

- Under Templates near the bottom, click Browse

- Find the template in the list using search or scroll to find it

- Click the template name in the list to expand its card

- Click Install to add the template to your spreadsheet

- Read more in the Tiller help center

Support & Documentation

- View documentation for the Retirement Planner spreadsheet for Microsoft Excel here in the Tiller Community.

- All Tiller Community Solutions are exclusively supported in the Tiller Community