Tiller CEO, Peter Polson, sat down for a discussion with Peter Joers, to discuss and share insights on managing money during uncertain times. Peter Joers brings deep financial expertise to this conversation, with a long career in finance. Joers founded his own investment firm, Avos Capital Management after senior leadership roles at Bank of America, Montgomery Securities, and Bridgewater Associates.

Watch the full interview with Peter Joers

Joers shared several powerful thoughts with us that could transform how you think about investing and building long-term wealth. Click here to listen to the full video interview. In this article we’ll cover:

- Why you shouldn’t worry about market uncertainty or getting things wrong

- A simple test to help you assess your investments

- Why focusing on the fundamentals like cash flow, risk assessment, diversification and cost is critical—for investing, for personal finance, and for financial education

Uncertainty Is Always the Norm, So Stop Waiting for Clarity

Think today’s markets feel uniquely uncertain? Joers disagrees.

“When I look back across my career and I try to remember what things were like at different periods, the answer I come back with is that it’s always felt uncertain. We’re more aware of the current uncertainties,” he said.

You have to stop waiting for certainty to invest. It never comes. The markets have always felt scary to someone living through them in real time.

Use the “Rip Van Winkle Test” for Your Portfolio

Joers advocates for what his partner calls the ultimate portfolio stress test: the Rip Van Winkle Test.

“You want the portfolio that you’re comfortable with, saying, ‘Look, I’m going to go to sleep, wake up 30 years from now, and be comfortable with that portfolio.’ If you don’t feel you have that portfolio, it’s probably a sign that you’re taking on too much risk.”

This exercise forces you to focus on long-term fundamentals rather than short-term predictions. If you can’t sleep soundly knowing your investments will be successful if they are left alone for decades, you’re probably taking unnecessary risks.

Even the World’s Best Investors Are Wrong Most of the Time

Working at Bridgewater—the world’s largest hedge fund—taught Joers profound humility about market predictions.

A Ray Dalio saying became Joers’s guiding principle: “Dalio knows that he’s going to be wrong all the time.” Even Bridgewater, with unlimited resources and brilliant minds, is hoping to be right around 55 percent of the time.

If professionals with armies of analysts can’t reliably predict markets, individual investors shouldn’t try to outsmart the system. Joers’s investment philosophy is to build portfolios that can “do well in all scenarios” rather than betting on specific predictions.

Growth Doesn’t Equal Investment Returns (What You Pay for It Does)

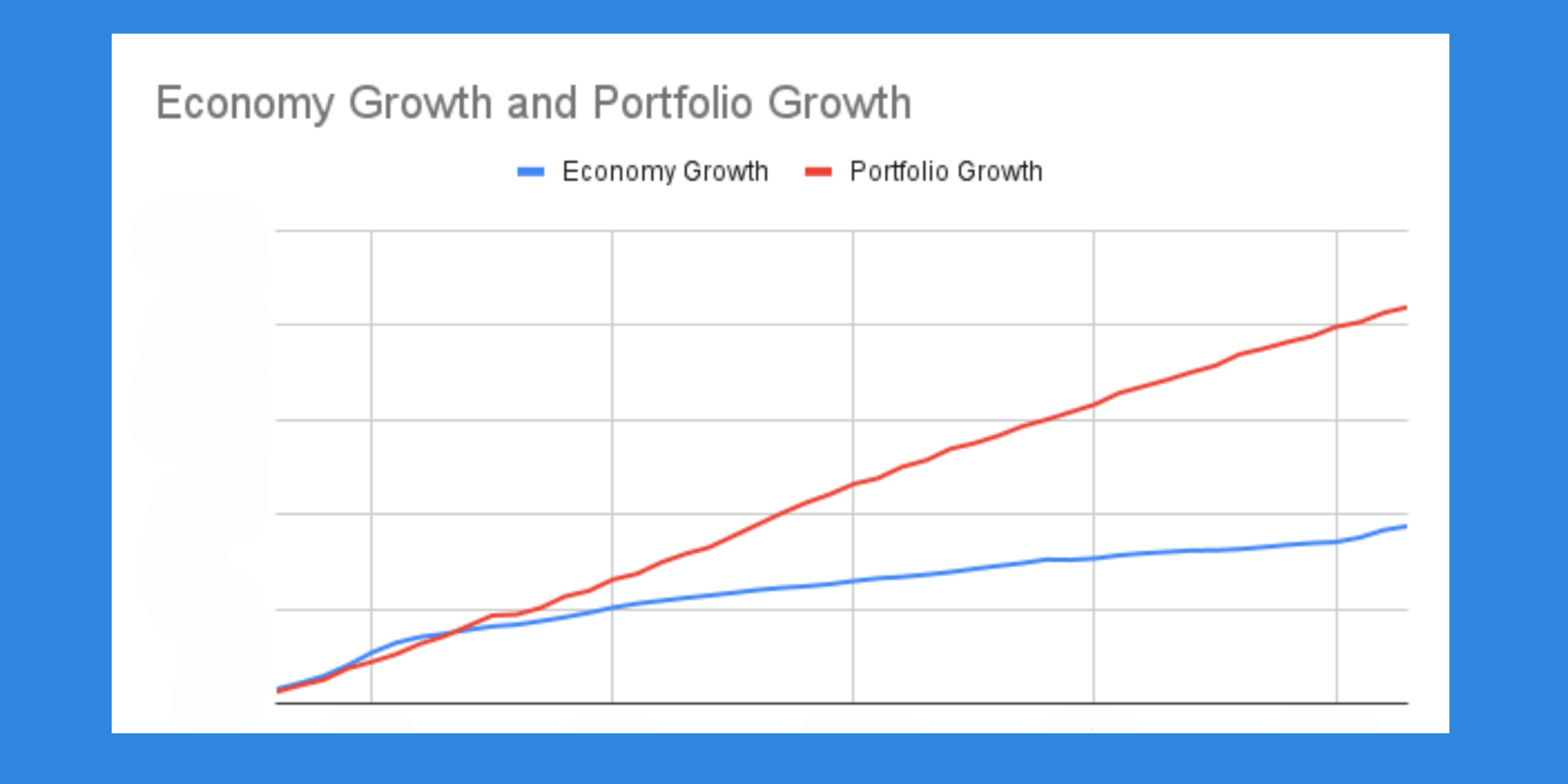

Here’s a counterintuitive reality that surprises most investors: economic growth doesn’t automatically translate to stock market returns.

Joers points to compelling research showing “zero relationship between the growth rate of an economy and the return on the equity market.” Growth, in other words, is not what matters. “It’s what you paid for that growth.” If you had to pump a lot of investment into an economy for it to grow, you won’t get the same amount of gains as if you hadn’t pumped in a lot of investments.

This principle applies everywhere, from individual stocks to entire countries. Amazing businesses can be terrible investments if you pay too much. Mediocre businesses can generate great returns if you buy them cheap enough.

Global Diversification Isn’t Optional Anymore

While U.S. companies dominate global markets, Joers warns against putting all your eggs in the American basket.

“We have the best companies in the world, hands down. Companies like Nvidia and Microsoft are the best companies in the world, the best managed. They have moats around their business. They’re wonderful. But what are you paying for them?”

Current U.S. market valuations remind him of dangerous historical periods. “We’re right there in sort of internet bubble or 1929” territory based on multiple metrics.

His solution is global diversification, which is more important than it has been in some time.

Beyond Investing: Cash Flow Is Your Financial Foundation

Joers returned to a fundamental truth: “Cash is the anchor, ultimately.”

Whether you’re managing personal finances or evaluating investments, understanding cash flow provides stability regardless of market conditions. He references legendary investors like John Malone, who “recognized early on that cash flow was what matters. It wasn’t earnings. It was how much cash a business generates.”

This also applies directly to your personal financial life. Understanding your cash outflows and their dependability creates the foundation that supports smart, long-term saving and investing decisions.

Teaching the Next Generation

One of the highlights of the conversation is when Joers discussed what he taught his own children and what he’d teach other children.

Joers talks about the dangers of stock-picking contests in schools. He’s concerned that they create either overconfidence because students pick short-term winners or pessimism because students lose money in the short term.

Instead, he believes that financial education should focus on fundamental wealth-building concepts like compounding, deferred consumption, and portfolio diversification.

The Bigger Picture: Building Wealth That Lasts

After 30 years of market ups and downs, Joers’s advice centers on timeless principles rather than trending strategies: diversify globally, focus on fundamentals over predictions, build portfolios designed for the long term, and accept that uncertainty is permanent.

The markets will always feel uncertain, but these principles have weathered every storm. As Joers learned from his mentor Ray Dalio, success comes not from being right more often, but from being prepared for being wrong.

Your financial life deserves the same thoughtful, long-term approach. Start with understanding your cash flow, build diversified portfolios you can sleep soundly with, and remember that boring often beats brilliant when it comes to building lasting wealth.

Ready to build the cash flow foundation that supports smart investing? Tiller’s spreadsheet-based tools help you understand every dollar coming in and going out, creating the financial clarity that makes confident investment decisions possible.